Technology is shaping how we deal with finances in everyday life, and it’s no surprise that even a teen needs guidance to handle money. I remember being a student myself, attending school with textbooks, supplies, and meal plans to cover, all on a limited budget.

Learning balance was not easy, especially when unexpected expenses like a broken phone or laptop showed up. That’s when I realized the role of simple tools and apps in managing my money better.

Over time, building habits like saving, investing, and keeping an emergency fund gave me the flexibility to avoid stress. The benefits of learning practical money skills early are huge—from covering repairs on a car to planning for long-term goals with compound interest.

For a parent guiding a young person or teenagers starting out, there’s a whole plethora of money-saving apps designed with teen-friendly features and options. A good guide not only highlights the usefulness of these tools but also addresses real concerns for families, helping both sides grow more financially savvy.

This guide explains what the best budgeting apps for teens are, why they’re useful, what features matter most, and which options teens are actually using—along with some honest concerns and practical alternatives.

What Are the Best Budgeting Apps for Teens?

At their core, budgeting apps for teens are simplified financial tools. Unlike adult apps that dive into credit scores, loans, and investments, teen-focused apps strip things back. They help track allowances, monitor spending, set savings goals, and sometimes link directly to prepaid debit cards.

The biggest difference is in design: they’re built for ease. Teens don’t need five charts and ten reports; they need a simple interface that answers one question: “Do I have enough for what I want?”

12 Apps To Help Teens With Money And Budgeting

When I first started exploring money tools for younger people, I noticed how quickly budgeting apps can change. For example, Mint, once extremely popular, is now being discontinued, reminding us that trends shift fast.

That’s why it’s smart to try what’s working today while keeping an eye on new updates arriving in the market. From my experience, the best choices are the ones that make sense for everyday use and really help teens understand the basics of managing their cash.

1. Acorns

Acorns is an investment app that makes saving simple by rounding up everyday purchases to the nearest dollar and automatically investing the spare change. It’s a smart way for teenagers to start learning about money with minimal effort while building confidence.

I like how the educational content inside the app helps teens learn step by step, making it easier to focus on growing their money over time without feeling overwhelmed.

2. BusyKid

BusyKid is a smart way that teaches kids how to handle money while giving parents the control they need. With a prepaid Visa card that can be easily controlled through the app, families can stay on the same platform where they can watch the bottom line.

It not only helps with budgeting but also enables earning, saving, and even investing, making it a complete tool for young people learning about real-life purse strings.

3. FamZoo

FamZoo is a family-oriented app that provides a virtual family bank to teach kids and teens smart money management. It helps parents set up allowances, track spending, and encourage savings, all while providing valuable financial lessons. From my experience, this kind of tool makes it easier for families to guide children step by step in building healthy money habits.

4. GoHenry

GoHenry is a prepaid debit card and app designed for teens and their parents. It allows families to set spending limits, make payments for chores, and help teenagers track spending. With this tool, kids can save money, learn financial responsibility, and gain confidence in handling their own budget step by step.

Goodbudget

Goodbudget is based on the envelope budgeting method that allows teens and families to create virtual envelopes for different spending categories. They can track expenses, save money, and stay on top by staying within budget limits, making it a simple yet effective way to practice smart money habits.

Greenlight

Greenlight, much like BusyKid, teaches financial lessons while keeping parents in the loop. It supports automated allowance and chore lists so kids can make money responsibly. With real-time notifications, families stay updated, and the app also features a MasterCard debit card with strong parental controls to ensure safe money habits.

iAllowance

iAllowance is designed for parents and teenagers to manage allowances and chores in a simple way. It helps teens learn about earning, saving, and spending money responsibly through a digital allowance system. This makes it easier for families to build consistent routines while teaching real money habits.

PocketGuard

PocketGuard may not specifically be for teens, but it is a budgeting app that focuses on simplicity and ease of use. Teens can link accounts, and the app will automatically categorize expenses, track bills, and provide insights into their spending habits.

Its In My Pocket feature helps users know how much money is left after everything is considered, which I find very useful for keeping track of daily finances.

Qapital

Qapital is a savings app that makes saving fun and easy for teens. They can set goals, create rules, and choose how they want to save money—whether by rounding purchases, adding a fixed amount daily, or using specific triggers. The app helps them automate the process and watch their money grow, turning small habits into long-term results.

Qube Money

I’ve personally found Qube Money to be a smart app for Teens who want better control over their money. It follows the classic envelope system, but in a modern way.

You can allocate your cash into digital cubes or envelopes, each set for different spending categories like food, clothes, or savings. This makes it easy to stick to your budget, save for specific goals, and build good budgeting and savings habits without feeling restricted.

11. Wally

I often recommend Wally as a simple yet powerful personal finance app for teenagers. It helps them track expenses, set savings goals, and gain useful insights into their spending patterns.

The app also allows expense tracking in detail and provides a clear overview of where their money is actually going, making budgeting less confusing and more practical.

12. YNAB (You Need a Budget)

I’ve seen how YNAB (You Need a Budget) works as a popular general budgeting app that really helps users take control of their finances. It’s a perfect choice for teenagers who want to learn how to budget effectively.

The app allows you to create a plan, track spending, and set financial goals. With its user-friendly interface and strong educational resources, YNAB becomes an excellent tool for teaching teens the true importance of money management.

Acorns

Round-ups invest spare change automatically—an easy first step into saving & investing.

BusyKid

Chores, allowance, and a prepaid card—earn, save, spend, and even invest as a family.

FamZoo

A “virtual family bank” that teaches saving, spending, and giving with parent oversight.

GoHenry

Prepaid card + app with spending limits, chores, and goals to build responsible habits.

Goodbudget

Simple envelope budgeting—plan spending in advance and stay on track together.

Greenlight (US)

Kids’ debit card with real-time controls, allowance automation, and savings goals.

iAllowance

Track chores and allowances digitally to teach earning, saving, and smart spending.

PocketGuard

Automatically categorizes spending and shows what’s “In My Pocket” after bills.

Qapital

Rule-based saving: round-ups, triggers, and goals that turn small actions into wins.

Qube Money

Modern envelope system with “qubes” that fund categories before you spend.

Wally

Clean expense tracking and goals to help teens see where money really goes.

YNAB (You Need a Budget)

Give every dollar a job—powerful, educational budgeting that builds real habits.

Why Teens Benefit From Budgeting Apps

- Learning responsibility: Apps turn money into something visible and trackable.

- Building savings habits: Goals feel more achievable when progress bars show each step forward.

- Encouraging smart decisions: Spending is no longer abstract—teens can see where every dollar goes.

- Strengthening family conversations: Parents and teens get a neutral space to discuss money.

One parent I spoke with told me her son started saving faster once he could “see his money grow” on the app’s screen. What felt like nagging before became his own choice to save.

Features That Actually Matter in a Teen Budgeting App

Not every app is worth downloading. The ones that last—the ones teens actually keep on their phones—usually share these qualities:

- Security & Privacy: Parents want reassurance that data isn’t at risk.

- Simplicity: If it feels like homework, teens will quit.

- Goal-setting tools: Saving up for a phone or trip feels motivating.

- Parental oversight: The best apps strike a balance between control and independence.

- Engagement: Rewards, visuals, or gamified progress keep teens coming back.

I’ve noticed that apps overloaded with graphs or jargon usually get abandoned within days. The simpler the design, the longer teens stick with it.

Concerns Parents Usually Have

Parents often ask the same questions when considering budgeting apps for their kids:

- Will this increase screen time? Yes, but often in a productive way. Teens aren’t scrolling aimlessly—they’re tracking goals.

- Is financial data safe? Reputable apps use encryption and don’t store sensitive details beyond what’s necessary.

- Do apps replace real lessons? No. In fact, they often make conversations easier by putting numbers in front of teens.

- Are paid apps worth it? Sometimes. Free apps work for basics, but paid ones often add useful parental features.

One mom mentioned she feared her daughter would “treat money like a game.” But she later admitted the gamification was the reason her daughter stuck with saving.

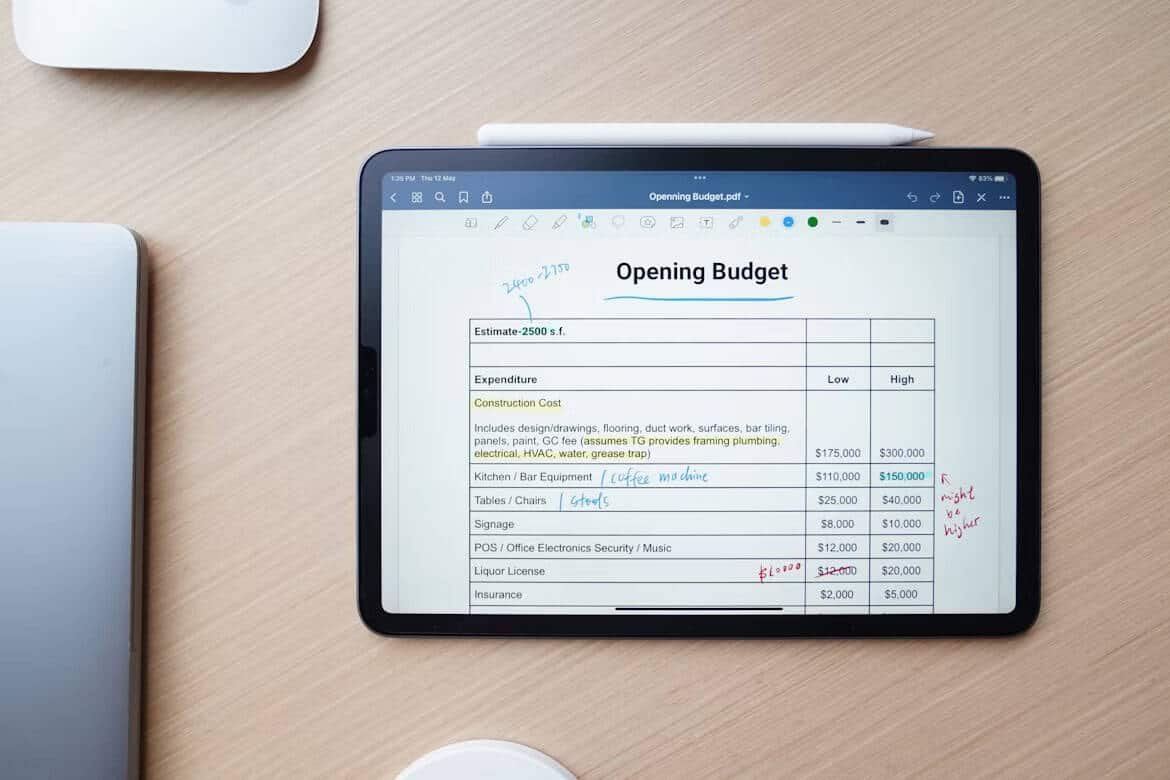

Alternatives to Budgeting Apps

Apps aren’t the only option. In fact, some families prefer more hands-on methods:

- Envelope method: Cash divided into labeled envelopes for saving, spending, and giving.

- Family spreadsheet: A shared Google Sheet where teens log income and expenses.

- Notebook tracking: For teens who prefer something tangible, writing down expenses still works.

I’ve seen teens thrive with these low-tech options, especially when paired with consistent family discussions. The method matters less than the habit.

How to Introduce Teens to Budgeting Without Overwhelming Them

- Start small with pocket money or a weekly allowance.

- Encourage them to set one goal (like saving for sneakers or a game)

- Let them track progress and make mistakes.

- Celebrate milestones—the first saved purchase feels like a big win.

From what I’ve observed, the biggest mistake parents make is overloading teens with too much detail too soon. The key is letting them discover that managing money is empowering, not exhausting.

Frequently Asked Questions—FAQs

At what age should teens start budgeting?

As early as they start handling money regularly—often around 12–13.

Do free apps work just as well as paid ones?

Yes for basics, but paid apps often add parental monitoring and advanced features.

Do budgeting apps really teach financial literacy?

They teach habits and awareness, which are the foundation of financial literacy. The deeper lessons still come from real-world guidance.

Fresh money guides you’ll love

Slash months off your auto loan with smart payment hacks.

Read nowYes, it’s possible: rent and still build your home fund.

Read nowStart early, save smart, and unlock your first place.

Read nowTurn the dream trip into a reality with fun saving tricks.

Read nowDisclaimer: The information provided in this article about the “Best Budgeting Apps in 2025” is for educational and informational purposes only. We do not endorse or guarantee the performance of any specific app or service mentioned. This content does not constitute professional financial advice.

2 thoughts on “Best Budgeting Apps for Teens That Actually Make Saving Fun”