Table of Contents

8 Tips for Paying for College Without Parents’ Help

Careful planning makes paying for college manageable, especially for students who must apply through the Free Application for Federal Student Aid (FAFSA®). By applying for scholarships, exploring federal and private student loans, and using available resources, you can turn a big financial undertaking into achievable steps. For many, this may be the first time dealing with finances, but these tips are designed to help you succeed and make your goals

Plan ahead

To plan ahead for your college journey, start early to match your career interests and determine what college experience you want. You can save money and lower tuition costs by taking AP® classes in high school.

Advanced Placement® courses give you college credits and can remove the need to take extra classes in college, helping you save on tuition. Speak with your counselor before you enroll, and choose a comfortable subject, especially if writing is not your strength, like AP® English.

You can also try Dual enrollment at local community colleges or universities to earn more credits in high school, decrease cost, and complete degree requirements to graduate earlier while getting a preview of college classes.

Begin saving during high school by doing a part-time job and collecting money for college expenses through temporary or seasonal opportunities, and build savings for textbooks to get ahead financially.

Make your savings work harder by putting birthday gifts into a high-yield, goal-based savings account at banks with the highest interest rates, such as SmartyPig® by Sallie Mae, where you set a goal, track your progress, and watch your money grow with interest.

Consider all your post-secondary education options

When you consider different post-secondary education options, research how students pick between 2-year and 4-year programs or career training. Each cost can vary depending on the institution, certificate, community college, and what you need for your field.

Review your options after high school, including requirements and criteria like employment rate, average cost, number of students, and location. Use the U.S. Department of Education’s College Scorecard, a resource that shows academic programs, costs, admission statistics, postgraduate job placements, and starting salaries. By starting early to plan ahead with a clear idea of your money goals, you can choose the best path.

Use your personal savings and income for college

Your personal savings and income can make a difference in college paying. Start with your savings and current income to see what’s available for paying college money. Use an amount you feel comfortable with and can afford, and make it a habit to save birthday or holiday gifts into your personal savings.

Keep your financial security by maintaining a rainy-day fund. Manage your income with a budget, setting aside a percentage from each income pay period to grow your college savings over time. You can use online budget apps or a worksheet to track money, reducing how much you need to borrow later.

Apply for scholarships

Apply for scholarships because they are invaluable in offsetting college costs. Reports like America Pays for College 2023 by Sallie Mae and Ipsos show many families use scholarships and grants to pay for college with free money.

Start a scholarship search on a scholarship database like Scholly Scholarships, which is free, easy to use, and shows opportunities that are tailor-made for you. There’s no sign-up—just select filters and start applying.

Check your college’s financial aid website for scholarship opportunities, explore organizations and financial aid websites, and call the financial aid office if needed.

Even if you don’t qualify for some scholarships, there are many easy scholarships for qualifying and applying for aid, giving you free money to bridge the gap between college costs and personal savings. Even a few dollars can buy a book.

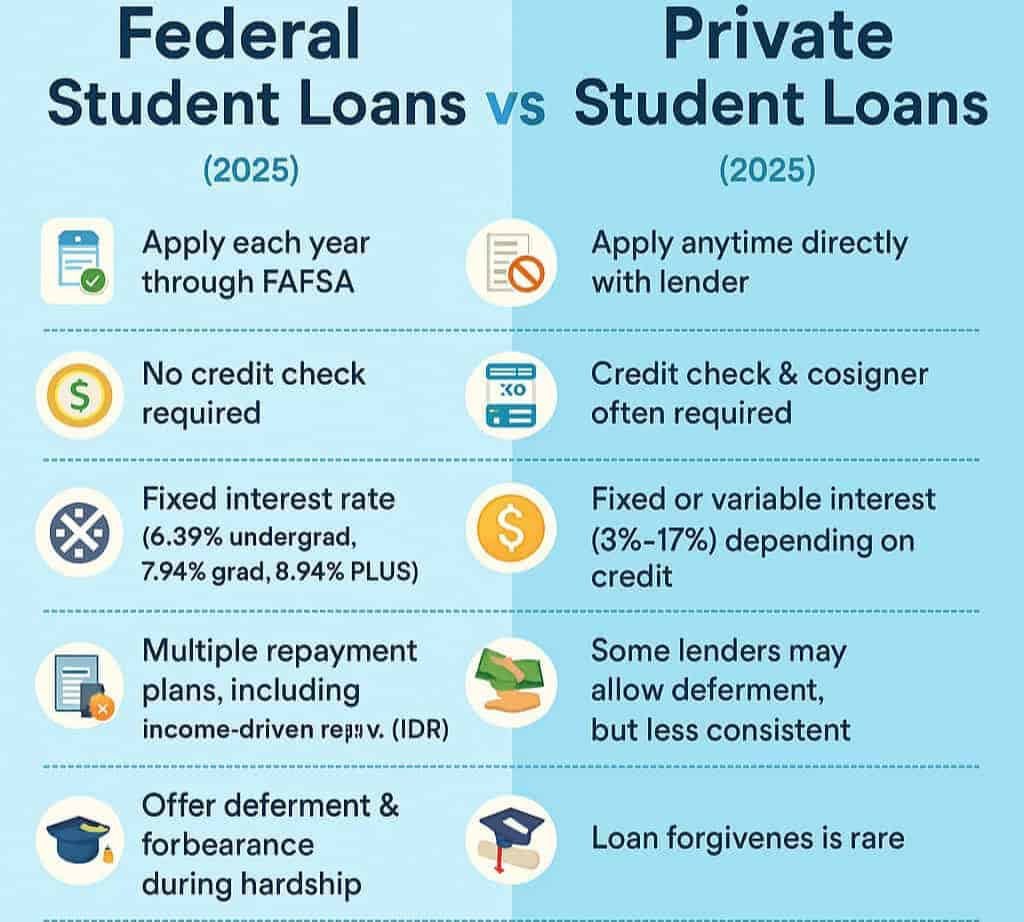

Federal vs Private Debt Landscape: As of 2025, about 92–93% of all student loan debt is federal, while private loans make up just 7–8% (EducationData.org). With new borrowing caps in place, that private share may rise—making it more important than ever to compare your options carefully.

Apply for financial aid

Apply for financial aid to get scholarships, grants, federal work study programs to cover college costs like tuition, room, board, books, and supplies. Fill out the Free Application for Financial Student Aid (FAFSA®), a free online application that helps colleges create your federal financial aid package with scholarships, grants, student loans, and work-study opportunities.

Make your FSA ID on studentaid.gov, which serves as your personal code and legal signature. Gather documentation such as driver’s license, Social Security number, parents’ Social Security numbers, birthdates, federal income tax returns, W-2 forms, bank statements, and investments like real estate, stocks, money market funds.

The FAFSA® opens October 1, and aid is given first-come, first-served, so submit your application early. Track deadlines for schools, submit the FAFSA® every year, and secure financial aid continuously.

Compare and evaluate your financial aid offers

Compare and evaluate financial aid offers after FAFSA® is approved. In springtime, you’ll receive financial aid offers from schools, so evaluate and understand your options.

Look at scholarships, free money, grants as free money, need-based work study, federal program, part-time roles like tutor, researcher, library assistant, and student loans that you borrow and pay back. Don’t just pick the largest financial aid offer—review which is best.

Sometimes, a smaller offer with more free money like scholarships, grants, and work-study can be better than a larger one with more loans, which add interest. Evaluate the financial aid, deduct the total financial aid from the cost of attendance (COA). The remaining balance may require personal savings, income, or student loans.

After savings and free money, consider student loans

Once savings and free money are used, consider student loans after you’ve reviewed your financial aid offer and need additional funding for school. Student loans cover the difference between your aid and costs. Federal student loans from the government differ from banks, credit unions, and private student loans.

Federal student loans include Direct Subsidized Loans for those with financial need, where interest doesn’t accrue while in school, after graduation, or during deferment (postponement of payments) with interest rates fixed. Direct Unsubsidized Loans don’t require financial need, and accrued interest during deferment or forbearance is capitalized into the principal loan.

Loan limits depend on cost of attendance and financial aid. Research repayment options for federal student loans, and if needed, explore private student loans from banks and financial institutions based on credit-based approval, credit score, income, debt, or a cosigner, a creditworthy individual.

For a private student loan, pick an interest rate and a repayment option like deferring, fixed, or interest-only payments. If you face trouble, contact the financial aid office for assistance and recommendations.

Get a part-time job or side hustle during college

A part-time job or side hustle during college can give you steady income while in school. Try side hustles like dog walking or babysitting for extra income sources. This steady income can help with day-to-day expenses, tuition, books, or paying student loans while in school.

Don’t hesitate to ask for help

Don’t hesitate to ask for help. Paying for college without a parent or guardian doesn’t mean this journey is alone. Use online resources to make informed decisions about paying for college.

Talk to the pros—your high school career counselor, email your college’s financial aid office, and talk to others who are paying or have paid for college. With proper planning, financial aid options, and a proactive process, you can pay for college and navigate your journey with confidence.

Frequently Asked Questions:

What is the best way to pay for college?

The best way to pay for college is by using other people’s money. Look for Scholarships, Grants, Federal Student Aid (FAFSA), work-study programs, and Company sponsored education reimbursement through your employer. These options can cover your tuition depending on your situation, making them powerful tools for funding your education without relying on parents.

Do parents have to be on student loans?

Parents don’t always need to be on student loans, but having a cosigner with good credit, stable income, and minimal debt helps the student secure a more favorable loan. While cosigners are often parents, sometimes friends, partners, or relatives cosign a student loan instead, offering flexibility for those financing their studies independently.

What is the biggest way the average family pays for college?

The biggest way the average family paid for college during the 2024-25 school year was through three-quarters of undergraduate families using parents’ savings and income to pay for college, spending about $15,754 on average. This shows how significant personal and family contributions are in covering educational costs.

Conclusion: You Can Do This Without Parents’ Help

It might feel intimidating to finance college on your own, but with the right mix of scholarships, grants, work, and sound budgeting, it is well within reach. Remember—your journey may be longer or just different from some others’, but that does not make it any less legitimate.

The key is persistence. Use it on everything, question things, seek out resources, and stay self-controlled with money. Your schooling is a personal investment, and with the approaches outlined here, you can do it your own way.

Now it’s your turn—start by filling out the FAFSA, applying for a scholarship today, or seeking tuition reimbursement work. Small steps will pave your path to a debt-wise degree.

Related Guides & Tools

Explore More Smart Financial Tips

Practical strategies on budgeting, earning, and debt management — handpicked to help you stay financially confident.