No matter where teens or teenagers are on their financial journey, it’s possible to turn their financial life around. Taking that first step in the right direction gets things moving in your favor, even if that hardest part feels challenging.

This list of 100 ways to start saving money today offers practical tactics that may not be life-changing alone but can make a real difference over time when you implement multiple suggestions.

Some take only a few minutes, while others need regular effort, but all are simple and designed so anyone can do them. These tips may not apply to everyone, so go through the list and find 10, maybe 15, that apply best to your life. By acting quickly, you may be saving more money than you ever thought possible.

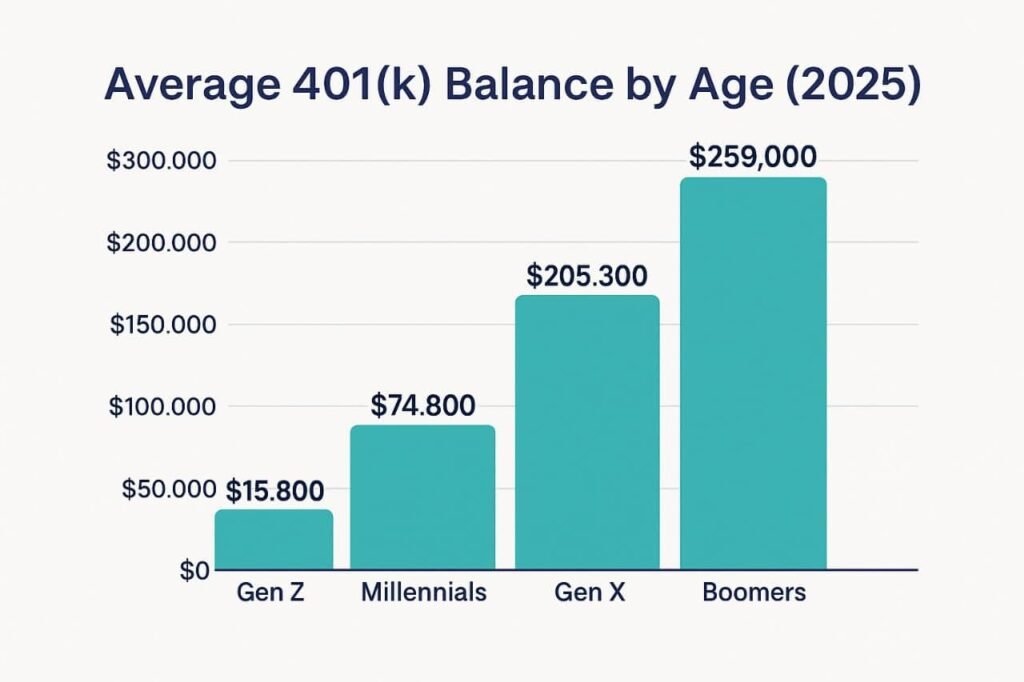

In 2025, the median balance of U.S. savings accounts was just $8,000, while 59% of Americans lacked emergency funds (Bankrate, 2025). Gen Z has shown resilience, with 72% taking financial action in the past year—41% cutting back on dining out (Bank of America, 2025).

1. Move Bank Accounts to Take Advantage of Perks and Earn More Interest

For many teens and teenagers, making a smart move with their bank accounts can give a big advantage. Many banks now offer special perks that help you earn more interest and avoid paying a monthly fee on your checking or savings account.

By researching the newest banking offers, you can find banks that give sign-up bonuses just for opening an account and setting up direct deposit. Some even provide attractive interest rates to new customers. It’s true that interest rates may not be as high as before, but it’s still worth a look to find the best option and make your money work harder for you.

2. Turn off the television.

Reducing TV and television time is a smart way for teens to save money and boost focus. Too much screen time leads to impulse spending through constant ads and advertising, which affect your budget and productivity. Cutting back lowers your electric bill, electricity use, and overall energy use.

Teens can cancel or downgrade their cable subscription, try cord cutting, or switch to streaming only when needed. Extra hours can be used for reading, exercise, or starting a side business or hobbies, all while increasing savings and finding more affordable entertainment options.

3. Stop collecting, and start selling

Many teens keep collectibles thinking their collection will grow in value, like Beanie Babies or Longaberger baskets. In reality, these items often end up on Craigslist or at a garage sale for less than their original cost. Understanding sunk cost is key—recall your financial goals and recoup money by selling through eBay, consignment, or other marketplace platforms.

Use smart strategy, proper pricing, and follow a selling guide to turn unwanted items into profit. Consider demand, supply, and opportunity cost to make informed decisions on what to sell and when.

4. Sign up for every free customer rewards program you can.

Joining rewards or loyalty customer programs from any retailer can help teens save more. Use a dedicated Gmail or Yahoo for promo email to keep track of signup offers and extra offers. Collect member ID, scan barcode, and use store apps to maximize perks and savings.

Combine coupons, discounts, and stack deals with rewards credit cards to earn points, cashback, or other redemption benefits. Keep these rewards organized in your wallet to make the most of every shopping trip.

5. Make your own gifts instead of buying stuff from the store.

Creating homemade gifts is a clever DIY money-saving idea for teens. Make food mixes, candles, bread, cookies, or soap with simple ingredients from your kitchen. These are inexpensive, frugal, and have a personal touch that’s often clutter-free and consumable, unlike store-bought items.

Adding a handwritten note shows generosity and makes occasions like holidays and birthdays more meaningful without straining your budget. Plus, learning new craft skills can be rewarding.

6. Master the 30-day rule.

The 30-day rule helps teens build impulse control by learning to wait before making a purchase. Practicing delayed gratification gives better perspective and time for a careful decision about need vs want.

This cooling-off period improves mindfulness, aligns with your budget, and prevents unnecessary spending. Over time, this habit strengthens financial discipline and stops regretful buys.

7. Write a list before you go shopping – and stick to it.

Having a shopping list before buying groceries ensures you follow your meal plan, avoid impulse buys and unplanned purchases, and reduce waste. Teens can do a pantry check first, add only what’s needed to the cart, and stay focused at checkout. This simple approach improves savings and keeps your food budget balanced without overspending.

8. Invite friends over instead of going out.

Organizing a potluck or pitch-in dinner at home gives teens affordable fun. With home entertainment like cards, board games, or sitting around a fire pit, you can enjoy a movie night, cooking, and BYO activities. It’s a great way to socialize in a budget-friendly way, stay in, and save money while still making memories with friends.

9. Repair clothing instead of tossing it.

Learning to sew with a needle, thread, or fixing a button helps teens avoid unnecessary clothing expenses. Adding a patch, mend, or hem, or even simple darning, are basic sewing skills that extend lifespan of clothes. This approach promotes frugal fashion and DIY repair, letting you keep your wardrobe fresh without buying new every time.

10. Don’t spend big money entertaining your teenagers.

For teens and children, low-cost fun can happen in your backyard or at the park. Activities like ball games, bike rides, garden projects, or crafts using newspaper roll spark creativity and build lasting memories. Spending time together outdoors with free activities promotes good parenting and saves money without needing expensive entertainment.

11. Negotiate rates with your credit card company or complete a balance transfer.

Many teens and young adults overlook how much their interest rate or APR affects their budget. A simple phone call to customer service using the number on the back of the card can help negotiate better terms with your issuer.

If you’ve made regular payments and are in good standing, you can use a balance transfer with a 0% intro offer as a bargaining chip to reduce fees or get a lower rate. Treat your credit card strategically—use leverage, compare options, and consider consolidation if you carry debt. Small steps like this can lead to long-term savings.

12. Clean out those closets.

Teens can make extra money and feel lighter when they clean out their closet and declutter. Set aside unwanted stuff and consider resell options through yard sales, eBay, Craigslist, or consignment.

You can also donate and get a tax deduction by keeping a receipt and listing items carefully. A good purge provides psychological relief, helps organize your space, and can put cash back into your wallet.

13. Buy video games that have a lot of replay value—and don’t acquire new ones until you’ve mastered what you have.

When it comes to video games, focus on replay value and mastery rather than buying constantly. Puzzle games and quest games offer longer playtime and better value.

Once finished, consider resale or trade-in at GameStop for store credit. Avoid growing your backlog, follow a clear strategy, and align your entertainment budget with actual usage. This approach makes gaming affordable while still fun.

14. Drink more water.

For teens, simply drinking water more often is a small lifestyle change that saves money and supports health. Having a glass before meals increases fullness, helping you eat less.

Carry a refillable bottle, choose restaurant water, and skip soda, juice, or tea. Clean tap water is free, offers real health benefits, and helps you spend less on drinks daily.

15. Avoid convenience foods and fast food.

Cutting down on convenience foods and fast food can transform a teen’s budget. A little meal prep during a weekend batch can provide snacks and ready meals made in a crock pot or slow cooker.

These options are inexpensive, healthy, and time-saving, with replacements that are easy to take with you. If you plan ahead, you’ll avoid unnecessary spending and eat better.

16. For heaven’s sake, quit smoking.

If any teen has picked up the habit, it’s important to quit smoking early. Cigarettes are an expensive habit and a serious health risk. Whether you go cold turkey, use nicotine replacement, try anti-smoking products, or even use an e-cigarette as a bridge, quitting brings huge savings, better wellness, and increased longevity. The best choice is to stop altogether before costs and damage build up.

17. Make a quadruple batch of a casserole.

Preparing a casserole in a batch cook session helps save both time and money. Teens living away from home can quadruple the recipe, freeze portions, and keep ready-made meals on hand.

Buying ingredients in bulk quantities lowers costs, while quick meals support family dinners or solo nights. This habit helps avoid takeout, save time, and save money consistently.

18. Turn off the lights.

Teens often forget the simple act of turning off lights. Making it a habit to use natural sunlight during the day can lower the electric bill. It improves efficiency, reduces per-watt cost, and increases overall energy savings. Switch lights off when leaving an unused room to cut down on the utility bill without effort.

19. Swap books, music, and DVDs on the Internet or at the library.

Instead of buying new media, swap books, CDs, and DVDs with others. Many teens can use their local library to borrow or barter, or try PaperBackSwap and other online trade platforms. Building a media collection this way ensures free entertainment and helps save money without sacrificing enjoyment.

20. Maximize yard sales.

Teens who love deals should learn to maximize yard sales. Explore garage sales to find housewares, shoes, clothing, or sports equipment at low prices. Go in with a shopping list and avoid impulse buying. Stick to only what you need to score deals without wasting money.

21. Install CFLs or LEDs wherever it makes sense.

Switching to CFL or LED light bulbs is a simple lighting upgrade for teens aiming to save money. These energy-efficient options use a quarter of the of the energy compared to incandescent, and while slightly expensive upfront, they’re cheaper over time.

They offer great efficiency, a longer lifespan, and a warm glow close to natural light. By swapping bulbs, you’ll see cost savings on your electricity bill and enjoy annual savings, even considering warm-up time or mercury disposal needs.

22. Install a programmable thermostat.

A programmable thermostat helps teens take temperature control seriously by managing energy usage for heat and cool cycles. With a smart schedule, you can regulate your home, reduce waste, and enjoy utility savings. This home automation trick requires minimal installation and cuts bills without extra effort.

23. Buy quality appliances that will last.

Investing in quality appliances like an energy-efficient washer and dryer offers long-term value. Good reliability and a longer lifespan mean fewer replacements. Do research, read Consumer Reports at the library, and compare upfront cost with long-term savings and replacement cost. Durability pays off.

24. Clean or change out your car’s air filter.

Keeping your air filter clean improves your car or vehicle gas mileage by up to 7%, saving around $100 per 10,000 miles. Follow the manual to clean or change it. A new filter costs roughly $10 and improves engine efficiency with basic maintenance.

25. Quit using credit cards.

For teens managing finances, avoiding credit cards helps limit debt and temptation. Hide card details, keep it out of your wallet, and use it for emergencies only. Keeping it out of sight builds control and reduces spending habit risks, helping you avoid trouble later.

26. Plan your meals around your grocery store’s flyer.

Strategic meal planning using the grocery flyer helps teens find sale items, apply discounts, and align ingredients with what’s in the pantry. By basing recipes on weekly deals, you keep your budget in check, lower the food bill, and enjoy frugal meals using a smart strategy.

27. Do a price comparison—and find a cheaper grocery store.

Simple price comparison of 20 items across multiple stores helps identify the cheapest store. Teens who track routine shopping can find winner locations and make them their regular destination, resulting in automatic savings without changing what they buy.

28. Make your own when you can.

Choosing homemade and DIY options like bread is easy, cheaper, healthier, and often tastier. Using simple ingredients and basic skills in the kitchen, teens can bake their own meals, enjoy a store alternative, and save money along the way.

29. Avoid stress-spending.

Many teens fall into stress-spending or emotional spending after tough days. Avoid unnecessary purchases by finding alternative relaxation activities like exercise, meditation, a short nap, reading, watching movies, or doing yard work. These healthy coping methods help avoid impulse buying.

30. Share your dreams with people you love.

Talking openly about goals and dreams with family and friends builds consensus for better planning. Teens can encourage each other to stay financially fit, build teamwork, and maintain motivation. A strong support system helps achieve big goals together.

31. Do a “maintenance run” on your appliances.

Running a regular maintenance run on appliances by clearing dust from vents using a vacuum boosts efficiency and energy savings. It gives a longer lifespan, helps prevent breakdown, and ensures your refrigerator, dryer, or HVAC stays in good shape. Regular cleaning and upkeep lead to utility savings.

32. Cancel unused club memberships.

Review your memberships, like gym or country club. If unused, cancel them to stop paying dues, avoid unwanted renewal, or unnecessary subscription fees. Teens can save money and reactivate later if needed.

33. Buy used when you can.

Opting for used or secondhand through consignment, thrift, or resale shops offers teens quality finds at lower prices. Visit a used equipment store or game store for clothes and more, paying pennies on the dollar. Make this a routine for budget shopping and cheaper alternatives.

34. Keep your hands clean.

Practicing washingwashingwashing hands regularly is an easy hygiene habit for teens to avoid bacteria and viruses, preventing high medical bills. Good sanitation in the bathroom or after raw foods builds healthy habits, improves productivity, and leads to overall savings.

35. Remove your credit card numbers from your online accounts.

Teens can delete credit card numbers from online accounts to stop impulsive buying. Delete stored info, create checkout friction, and rethink purchase at the extra step. This simple act improves spending control and helps break habit loops.

36. Give the gift of labor.

A gift of labor like babysitting, pet sitting, or lawn care is a thoughtful, no-cost option. Teens can offer service gifts to new parents or homeowners, creating practical, valuable gifts that save money while showing care.

37. Do holiday shopping right after the holidays.

Post-holiday shopping is the best time for clearance and discounts on themed items for next year. Grab cards, wrapping paper, bows, gift bags, Easter kits, Mother’s $6,400Day and Halloween decorations, and Christmas goods during post-holiday sales.

38. Join up with a volunteer program.

Participating in volunteering connects teens with the community, encourages exercise, and helps them meet people. It’s a positive project that lifts spirits, provides free entertainment, and is fulfilling. Joining committees, groups, or any free activity builds social skills and a purposeful mindset.

39. Declutter to save your sanity and some cash.

Regularly declutter your room, evaluate your things, and get rid of clutter. Focus on value, resale, and keeping your space clean and organized. Improving the perceived value of your house has a psychological benefit and keeps your lifestyle frugal.

40. Try generic brands of items you buy regularly.

Switching to generic brands or store brands instead of name brands is cheaper and often the same quality. It reduces marketing difference costs and lowers your regular grocery bill. Adjusting your budget this way creates more savings by learning to switch brands smartly.

41. Stick to reliable, fuel-efficient cars.

Choosing reliable cars that are fuel-efficient saves money through better miles per gallon. Driving a vehicle at 25 mpg vs 15 mpg saves 2,133 gallons, which at $3 per gallon equals $6,400 in savings.the purchase Teens should do research, maintain driving habits, and keep up with maintenance for the long-term benefits.

42. Prepare some meals at home.

Simple home cooking with a cookbook like Mark Bittman’s How to Cook Everything teaches useful kitchen skills. Making recipes and dishes at home is easier,$6,400 in cheaper, and healthier than take-out. You can prepare in advance and even create fast-food-type meals as a better alternative.

43. Avoid the mall.

Going to the mall often leads to temptation, window shopping, and unnecessary entertainment spending. Teens can avoid overspending by keeping to their budget and trying alternative activities like a walk outdoors, solving puzzles, or watching movies, which also helps avoid impulse buys.

44. Master the 10-second rule.

The 10-second rule helps cut impulse buys. When something is in your cart at checkout, stop, evaluate, and decide based on need vs. want. If it’s not essential, put back the item and focus on mindful spending and better decision-making.

45. Rent out unused space in your home.

Families or teens with unused space like a bedroom or in-law suite can rent it on Airbnb in a tourist area. This creates extra income, but always consider risk and take steps to protect family and protect possessions while generating passive income.

46. Create a visual reminder of your debt.

Teens can stay motivated by tracking debt with a progress bar. Mark each payoff step until the zero goal is reached. Filling it in acts as a reminder and a visual tracker that keeps your budget focus strong, building momentum toward debt freedom on the progress chart.

47. Cancel magazine subscriptions.

If magazines remain unread, end the subscription. Call the subscription department to cancel, and you may even get a refund or prorated amount. Clearing the pile of magazines avoids automatic renewal and boosts savings.

48. Eat breakfast.

A healthy breakfast gives energy and helps curb appetite. Something inexpensive like oatmeal is a morning habit that’s nutritious, quick, and cost-effective. Eating early can prevent expensive lunch choices, making it a simple way to save.

49. Swap babysitting with neighbors.

Parents and neighbors can arrange babysitting swaps. Families and parents take turns swapping nights, building trust while enjoying evenings free. It’s a no-cost option that helps everyone save money through a practical childcare exchange.

50. Don’t fear leftovers: Jazz them up instead.

Using leftovers is a great way to make cheap meals. Try chaining—reuse them in a new dish like ham and rice turned into fried rice or black beans and rice. With creative cooking, you can repurpose food and always save money.

51. Go through your clothes—all of them.

Sort your clothes in your wardrobe and closet. Move items from the back of the closet or dresser, then rotate them. You’ll rediscover outfits, refresh your style, and avoid buying new. This simple step helps you organize and spend less.

52. Brown-bag your lunch.

Packing a brown bag lunch for school or a work lunch saves money. With meal prep and thoughtful preparation, you can create an enjoyable, inexpensive meal. It’s a habit that impresses co-workers while supporting frugal eating.

53. Learn how to dress minimally.

Adopt minimal dressing with a mix-and-match wardrobe. Choose timeless, simple pieces that fit a professional look. Having fewer clothes still gives endless options through a clear fashion strategy, helping with less spending.

54. Ask for help and encouragement from your inner circle.

Seek help and encouragement from friends and family in your inner circle. Their suggestions and support can reduce spending and provide insights. This accountability helps build personal finance goals and keeps you motivated.

55. Try to fix things yourself.

Use DIY repair with tutorials or videos to fix items. This free learning builds new skills, supports maintenance, and helps save money. Developing self-reliance means you can repair instead of replace, which pays off long-term.

56. Keep an idea notebook in your pocket.

Carry an idea notebook to jot down thoughts and avoid forgetfulness. This helps save time, save money, and ensures you capture ideas. With productivity improved, the daily habit supports creative flow and prevents loss of good ideas.

57. Invest in a deep freezer.

Buying a deep freezer is smart for bulk buying and lower prices. With extra freezer space, you can store homemade meals and store food for later. It creates savings through advance preparation and works as a cost-effective investment.

58. Look for a cheaper place to live.

Managing housing costs matters for teens planning ahead. Seek cheaper rent and consider the cost of living in an expensive area. A move could bring budget differences, financial relief, and better ways to evaluate overall expenses for long-term affordability.

59. Check out free events in town.

Engaging in your community is fun with free events. Use local parks, basketball courts, and tennis courts, or try disc golf and trails. Enjoy the outdoors, explore free fun, and discover entertainment that helps you discover local opportunities.

60. Inflate Your Tires

Many teens and teenagers overlook how simple it is to inflate their tires, but it can make a real difference in saving money. If your car’s air pressure is even two PSI lower than the recommended level, you lose about 1% of your gas mileage. Most cars are five to ten PSI below normal, which means by simply filling your tires, you can boost your gas mileage by up to 5%.

It’s easy: check your car’s manual to find the recommended tire pressure, then go to a gas station. Borrow a tire air gauge, usually available in both urban and rural places, then use the air pump to fill them up properly. This simple step is like getting free gas every time you drive.

61. Start a garden.

For a teen budget, try gardening in your yard; use a tiller, and plant and weed tomato plants for healthy food and an inexpensive hobby. Learn canning and turn your tomatoes into tomato juice, sauce, paste, ketchup, pasta sauce, and pizza sauce for a tasty summer harvest that stretches money.

62. Inflate your tires.

A teenager who drives should watch tire pressure (PSI) to boost gas mileage and fuel efficiency; check the manual for the recommended level and use an air gauge at the gas station air pump. Check tires, fill up, enjoy the “free gas” feel from better mpg, and save fuel every week.

63. Dig into your community calendar.

Use the community calendar to find free meals, free entertainment, and local events via the town website, library, or city hall. Track upcoming events and free stuff to stay informed and keep teen fun affordable.

64. Take public transportation.

Choose public transit like a bus or train on your city system; an annual pass cuts parking costs and commute stress. It’s cheaper than a car, brings savings, and is a great transportation alternative for teenagers.

65. Cut your own hair.

A simple haircut with clippers and scissors suits a simple hairstyle; use a garbage bag by the bathroom sink for neat DIY grooming. Get free haircuts with practice, try self-cuts, and enjoy steady personal care savings.

66. Carpool.

Start a carpool with coworkers or a spouse so one household uses one car for the commute; you save money and reduce wear and tear. Add fuel savings with each shared ride and cut transportation costs like a pro.

67. Design your ‘debt snowball.’

Build a debt snowball: list balances, create a repayment plan, prioritize debts, and set the order of payoff. This strategy drives early payoff with a clear plan of action, strong motivation, and a path to financial freedom through smart budgeting.

68. Get a crock pot.

A crock pot (aka slow cooker) lets teens dump ingredients, let them simmer, and come home to dinner ready. It yields inexpensive meals, tasty leftovers, flexible recipes, and steady money-saving wins from regular home cooking.

69. Do some basic home and auto maintenance on a regular schedule.

Mix home maintenance and auto maintenance on a monthly schedule: inspect, fix, and prevent problems with simple upkeep. Catch early issues to avoid disasters, protect property value, and earn long-term savings.

70. Buy staples in bulk.

Use bulk buying for staples that are non-perishable, like trash bags, laundry detergent, and diapers; choose the larges packages for lower cost per use. Bank long-term savings on household essentials teens use often.

71. Pack food for road trips.

On road trips, bring snacks and meals you pack ahead to avoid stops and high restaurant bills or convenience foods. Take a park break to save time, save money, and protect your travel budget.

72. Go through your cell phone bill, look for services you don’t use, and ditch them.

Audit your cell phone bill for unused services; try smaller carriers and switch providers to lower the lot on your monthly bill. Review charges, save money, and ditch extras teens rarely need.

73. Consolidate your student loans.

For student loans, consider consolidation at low interest rates with a combined package; even a reduction on a $10,000 loan like a 1% cut equals $100 savings. You can refinance for easier loan management and a clear payment plan.

74. When buying a car, look only at used models.

Choose used cars to avoid depreciation that hits when you drive off the lot and values drop in value. Teens get transportation savings with warranty period options on good-condition to excellent-condition pre-owned cars—budget-friendly with decent resale value.

75. Hit the library—hard.

Your library lets you borrow books, movies, and CDs; try foreign language learning, free internet, and newspapers. Join community events to enjoy free resources and cost-free entertainment that levels up teen knowledge.

76. Use a simple razor to shave.

Use a razor—a safety razor is cheap—do a shower shave with soap lather and swap blades as needed. It’s an electric razor alternative to multi-blade expensive setups; master a wet shave with practice technique.

77. Find daily inspiration for making intelligent moves.

Seek inspiration from children, a spouse, or a community figure, and set a personal goal like early retirement. Keep a good-condition picture of an expensive item in your wallet as a constant reminder to build motivation and stronger financial discipline.

78. Learn about all of the benefits your company offers.

Ask HR about benefits and job perks like free tickets, personal improvement, and employee match for retirement funds. Maximize savings with workplace advantages and better financial planning.

79. Make your own cleaning supplies instead of buying them.

Try DIY cleaning: mix laundry detergent, Goo-Be-Gone, Glade, Windex, and Soft Scrub with homemade recipes. It’s cheaper, takes minutes to make, and helps you save money like a savvy teen.

80. Suggest cheap activities when meeting up with family and friends.

Pick cheap activities with family and friends; suggest first to influence group choices, like the park, shooting hoops, or a golfing alternative. Skip greens fees and enjoy frugal socializing with budget-friendly fun.

81. Don’t speed.

Avoid speeding to improve gas efficiency and lower fuel usage; a ticket or fine means higher insurance premiums after a traffic stop. Keep to the speed limit for savings and avoid penalties.

82. Read more.

Daily reading from the library or your own books is a cheap hobby that’s beneficial for learning. Improve skills in a cozy place with free entertainment and steady personal growth.

83. Buy a smaller house.

A smaller house or modest home with less space fits a teen family budget and stays affordable. You save money, avoid overspending, and skip unused extra room to reduce housing costs.

84. Drive a different route to work.

Pick an alternate route to avoid temptation from the automatic stop in your daily routine; even a longer route can save money if you skip indulgences. Make a commute adjustment and a lasting habit change.

85. Always ask for fees to be waived.

Politely waive fees like sign-up fees for any service—just ask directly (e.g., cellphone sign-up). You get a lower bill through negotiation, avoid excessive fees, and secure meaningful cost reduction.

86. Don’t overspend on hygiene products.

Smart hygiene buys like basic toothpaste and deodorant are cheap options that work with regular use and good cleanliness. Stick to daily bathing, no need for luxury, keep budget hygiene, and skip the $40 facial scrub.

87. Eat less meat.

Less meat lowers costs since it’s expensive; check nutritional value from fruits, vegetables, and beans as protein staples. Teens get better value, try vegetarian days for bundle savings, and have a steady meat reduction.

88. Use a brutally effective coupon strategy.

Run a coupon strategy with the grocery flyer and a shopping list; collect sale savings and discounts while you avoid unnecessary items. Use stacking for double savings and plan ahead like a budgeting pro.

89. Air seal your home.

Do air sealing to stop leaks; get better summer cooling and winter heating without costly energy loss. It’s an afternoon project—follow the DOE guide for utility savings and a more efficient home.

90. Make your own beer or wine.

With homebrew, make beer or wine in five gallons for a steep discount as you’re mastering the process and using the right equipment. Press juice, fill bottles, and enjoy an activity with friends and great homemade beverages.

91. Make sure all your electrical devices are on a surge protector.

Use a surge protector for your entertainment center and computer equipment to block a power surge and ensure damage prevention. A basic surge strip lets you plug in devices, tame phantom energy, unplug unused devices, and gain electricity savings.

92. Get on the automatic repayment plan for any student loans you have.

For student loans, choose automatic repayment for a rate reduction and steady monthly savings via auto-debit. It requires less effort for bill payment, yields interest savings, and builds financial discipline.

93. Cut down on your vacation spending.

Trim vacation spending by skipping the extravagant trip; try car travel to local sights for a weeklong break that’s cheap and memorable. Use travel rewards on credit cards for free hotel stays and airfare.

94. Cancel the cable or satellite channels you don’t watch.

If cable satellite channels or a premium package like HBO, Starz, or Cinemax are rarely watched, rent movies instead. Cut unnecessary expenses, cancel, and save money month after month.

95. Exercise more.

Daily exercise—walking, jogging, stretching, or light muscle work—can be a home workout and free fitness. You get health benefits from a daily habit that rewards both body and wallet benefits.

96. Utilize online bill pay with your bank.

Use online bill pay at your bank to monitor balance and gain overdraft prevention; skip stamps and paper checks with electronic payment. Just submit the form for convenience—often a free service.

97. Connect your entertainment center and/or computer setup to a true smart power strip.

A smart power strip uses a control device to cut phantom power and reduce drain on your workstation—monitor, printer, scanner—and entertainment console—cable box, TV. Expect real energy savings without changing your routine.

98. Don’t beat yourself up when you make a mistake.

Financial mistakes are learning chances—shift your mindset, use reflection, and capture the value for improvement in your financial habits. Practice self-compassion for growth along your personal finance journey.

99. Always keep looking ahead.

Focus on the future; turn past mistakes into lessons aligned with your goals and steady improvement. Keep a positive outlook, keep planning, don’t dwell, and build financial discipline with renewed motivation.

100. Never give up.

Show persistence in the debt fight; read personal finance blogs and their archives for inspiration and motivation to keep going. Build resilience through your debt journey and stick to clear financial goals.

Money-Saving Guides (YouthBudget)

Best tips to save faster for your biggest goals — car, apartment, house & more.