What Is a No Spending Challenge?

The No-Spend Challenge is like sending your wallet on a much-needed vacation. For a set time — a week, a month, or even longer — you hit pause on all the “extras.”

That means saying no to the daily latte run, scrolling and clicking “add to cart” at 2 a.m., or grabbing snacks just because you’re bored. Instead, you focus only on the essentials: food, rent, bills, and transport.

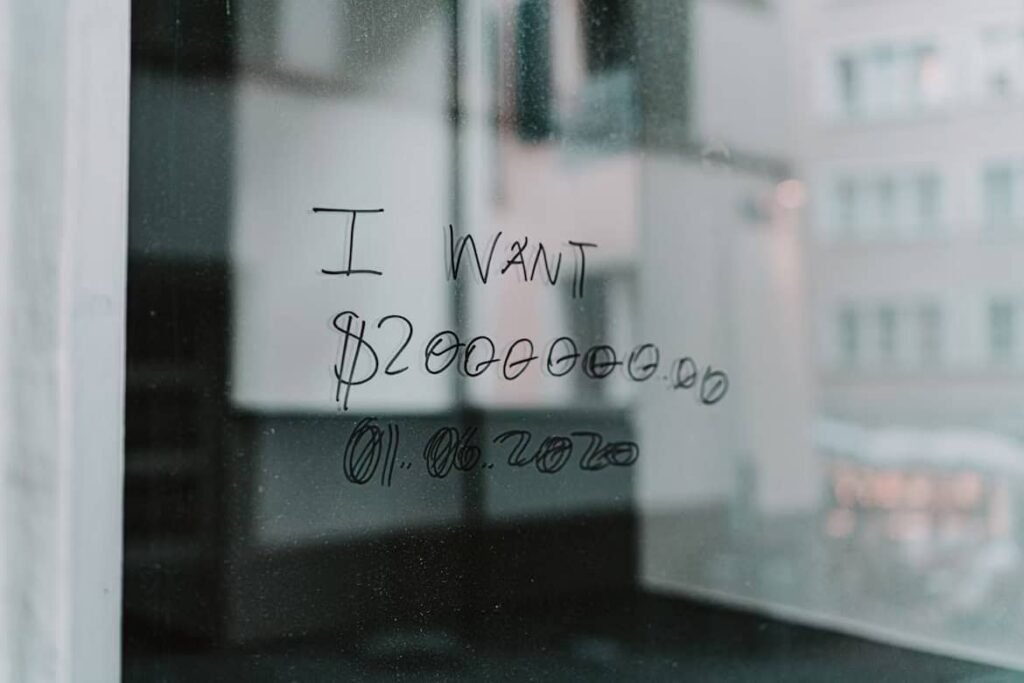

Why do this? Because those “just this once” spends add up fast. Before you realize it, you’re wondering where half your paycheck disappeared. The challenge teaches you one of the most powerful money lessons: knowing the difference between a want and a need. And trust me, once you learn that, you’ll never look at your money the same way again.

How the No Spending Challenge Works Step by Step

You set the rules. Maybe you start small with a 7–14 day sprint, or if you’re feeling bold, you stretch it to a whole month (or even three!).

During this time:

- Cover the basics: rent, groceries, bills, transport.

- Cut the extras: no eating out, no impulse Amazon orders, no “just one more” movie nights.

And here’s the magic: the tiny leaks you never noticed — the burger you grab on the way home, the midnight online order — suddenly become obvious. Plug those leaks, and your wallet feels heavier and your stress feels lighter.

Benefits of Doing a No Spend Challenge

The No-Spend Challenge isn’t about depriving yourself — it’s about gaining control. By doing a no shopping challenge or a short-term frugal living experiment, you learn the real difference between needs and wants. The benefits are huge.

- You save more. Extra cash goes straight to your savings or that debt you’ve been meaning to crush.

- You stress less. With money under control, you breathe easier.

- You grow stronger habits. These new habits stay with you long after the challenge ends.

Why Young Adults Should Embrace this Challenge

If you’re 16–30, this challenge is basically your money gym. You’re just learning how to manage your own cash, and it’s super easy to slip into habits that hold you back.

The No-Spend Challenge forces you to take a hard look at your spending, sharpen your self-control, and build habits that can set you up for a stronger, safer financial future.

Preparing for the Challenge: Tips and Strategies

Before you begin a No Spend Challenge, plan it like a project. Choose your timeline: maybe a week-long spending detox, a 14-day money cleanse, or a 30-day no-buy challenge. Having a clear start and end date keeps you motivated.

Next, write down a savings goal — whether it’s building an emergency fund, saving for a trip, or just breaking free from impulse buys.

- Set a goal. Saving for a phone? A trip? Or just want to stop living paycheck-to-paycheck? Write it down. Goals keep you grounded.

- Sort needs vs. wants. Once you’re clear, resisting temptation becomes way easier.

Involving Friends and Family in Your No Spend Challenge

Tell your friends and family what you’re doing. Not only will they get it, but some might even join you. Instead of pricey nights out, suggest:

- A picnic in the park

- Movie night at home

- A game night or potluck

You’ll be surprised how much fun you can have without spending much (or anything at all).

How to Stay Motivated During a No Spending Challenge

Joining a No Spend Challenge feels empowering, but it also comes with real tests. Social events, sales notifications, and late-night online browsing can all trigger spending urges. This is why some people also call it a “self-control challenge.” To stay focused, remind yourself of your main goal and find budget-friendly activities that replace your old habits, like game nights, outdoor walks, or free local events.

Friends might invite you to events that cost money, which can make you feel left out or frustrated. To handle this, talk to your friends about your goals and ask for their support. Suggest fun, low-cost options like game nights or walks in nature. These can be fun and easy on your wallet.

Managing Triggers and Impulse Buys in a No Spend Challenge

Another big challenge is the urge to buy things on impulse, especially when ads and deals seem hard to ignore. To fight this, make a clear list of your personal goals for the No Spending Challenge.

Keep this list somewhere you’ll see it often, like on your wall or phone. These reminders can help you stay focused. You can also use budgeting apps to track your progress and see how your money habits improve over time.

Fun and Free Activities During a No Spend Challenge

Looking for low-cost ways to have fun can make the No Spending Challenge more enjoyable. Join free local events and workshops, or use your library for fun and learning without spending money.

Try hobbies like cooking or crafts that don’t cost much and keep your mind off shopping. When you find fun, low-cost activities, the challenge feels less like a sacrifice and more like a chance to explore and grow.

Building a Lasting Money Mindset After a No Spend Challenge

Ultimately, overcoming the challenges of the No Spending Challenge can lead to greater self-awareness and financial literacy. Embracing this journey will empower you to navigate obstacles with resilience while still enjoying life’s offerings.

Reflecting on the No Spending Challenge Journey

When the challenge ends, pause and look back. Ask yourself:

- What tempted me most?

- Did I actually feel better spending less?

- Which purchases truly added value to my life?

Write these down in a journal. You’ll see patterns that help you shape your future money decisions.

Using Journaling to Deepen Your No Spending Challenge Insights

To help with reflection, try journaling prompts that make you think more about your spending habits. Ask yourself questions like, “What feelings or habits made me spend before the challenge?” or “How did spending less affect my daily life and happiness?”

Also, think about your values and goals. Ask, “Which things I bought truly support my long-term dreams?” These questions can help you see which expenses really add value to your life.

Applying No Spending Challenge Lessons to Everyday Life

As you think about your future money goals, use what you learned from the No Spending Challenge in your daily decisions. Keep knowing the difference between needs and wants. Spend with purpose, and make smart choices that match your values.

Going back to normal doesn’t mean going back to old habits. It means choosing a mindful way to spend—focusing on things that bring lasting happiness, not just quick rewards.

Building a Lasting Financial Mindset After the No-Spending Challenge

In the end, thinking about the No Spending Challenge and using what you learned helps you build a strong money future. Careful spending brings not just financial safety but also peace of mind.

As time goes on, keep looking back at your goals and experiences. Change your money plan when needed to match your growing values and dreams.

What to Do After Completing a No-Spending Challenge

The No-Spend Challenge is just the beginning! If you’re serious about saving smarter, spending wiser, and building strong money habits, check out these guides I’ve created just for you:

Fresh money guides you’ll love

Slash months off your auto loan with smart payment hacks.

Read nowYes, it’s possible: rent and still build your home fund.

Read nowStart early, save smart, and unlock your first place.

Read nowTurn the dream trip into a reality with fun saving tricks.

Read now