Master Your Finances with Professional Infographics and Interactive Calculators

Access our comprehensive collection of visual guides and powerful tools designed specifically to help students and young adults achieve financial literacy and independence.

Explore ResourcesWhy Our Infographics and Interactive Calculators Stand Out

We combine visual learning with practical tools to deliver maximum financial education impact

Visual Learning

Our infographics transform complex financial concepts into easy-to-understand visual formats that enhance retention and comprehension.

Interactive Tools

Experience-based learning through interactive calculators that provide personalized insights and actionable financial planning.

Student-Focused

All resources are specifically designed for student budgets, lifestyles, and financial challenges you actually face.

Trusted Financial Education Resources

Built on Expertise, Experience, Authoritativeness, and Trustworthiness

Expertise

Created by financial educators with years of experience teaching money management to students and young adults.

Experience

Tools tested and refined through real-world use by thousands of students across multiple educational institutions.

Authoritativeness

Recommended by financial advisors and educational institutions as trusted resources for financial literacy.

Trustworthiness

All calculations and financial advice follow established financial principles and best practices.

Financial Education Infographics

Visual guides that make complex financial concepts easy to understand and apply in real life

Budgeting Methods Comparison

Visual comparison of 50/30/20, 80/20, and Zero-Based budgeting methods to help you choose the right approach.

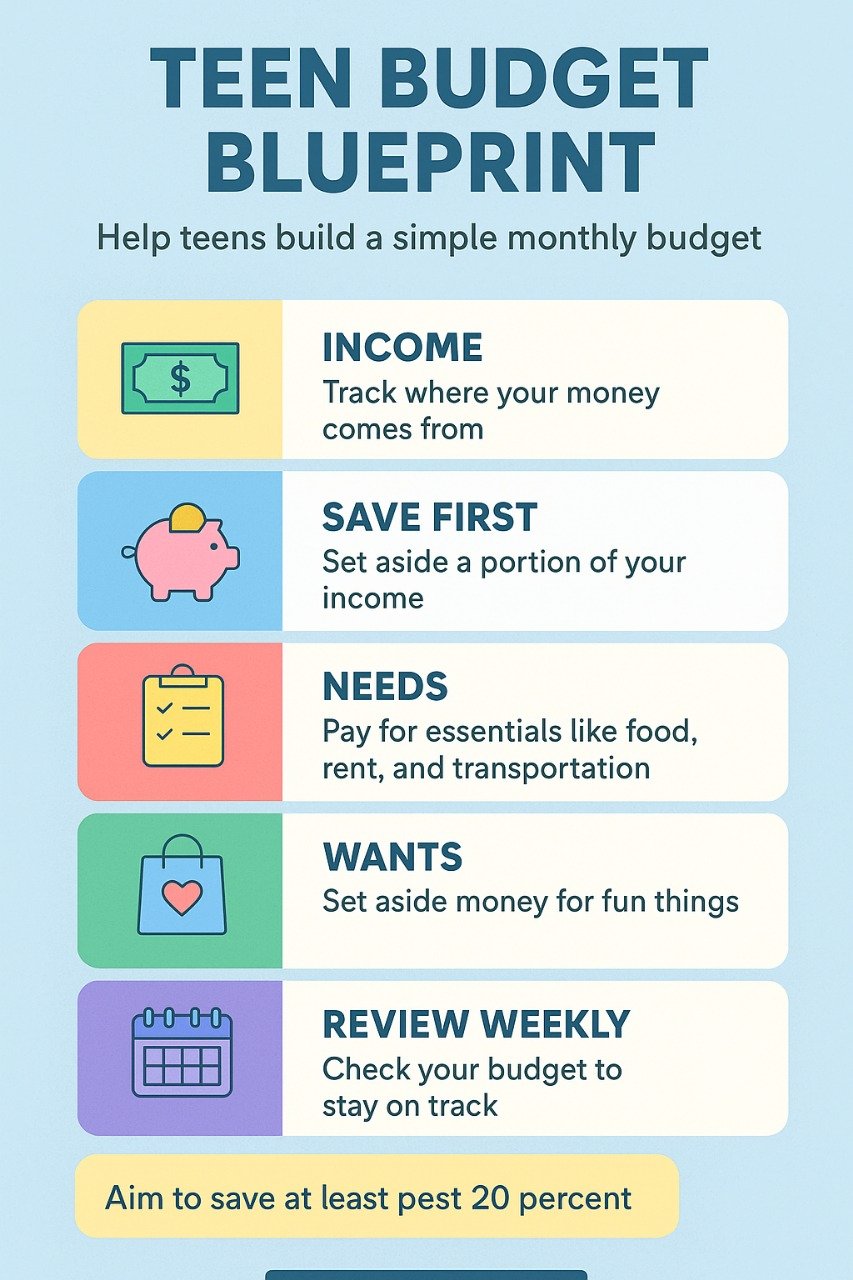

Teen Budget Blueprint

A step-by-step guide to creating your first budget as a teenager with practical examples and tips.

How to Save for Your First Car

A visual roadmap to saving for and purchasing your first vehicle while maintaining financial stability.

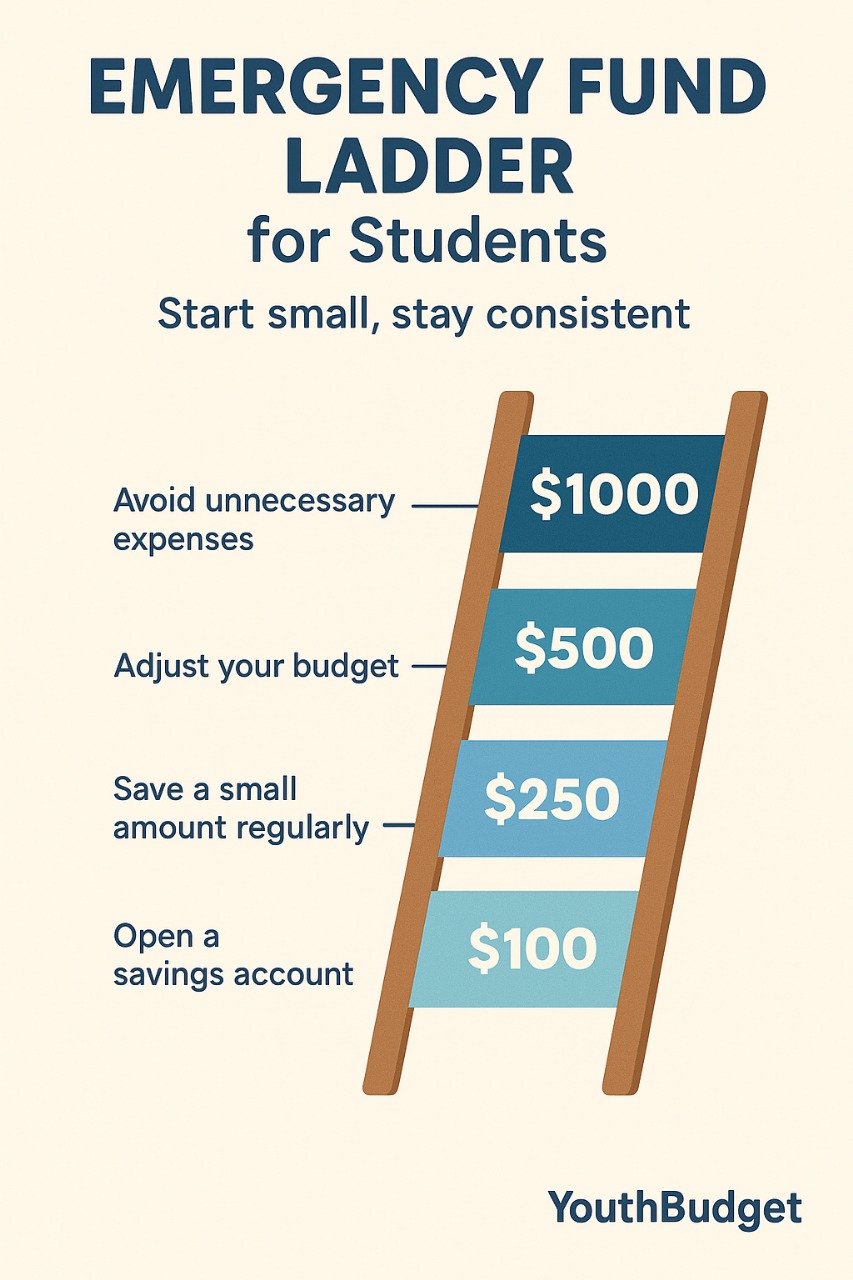

Emergency Fund Ladder

Build your financial safety net with this step-by-step approach tailored for student budgets.

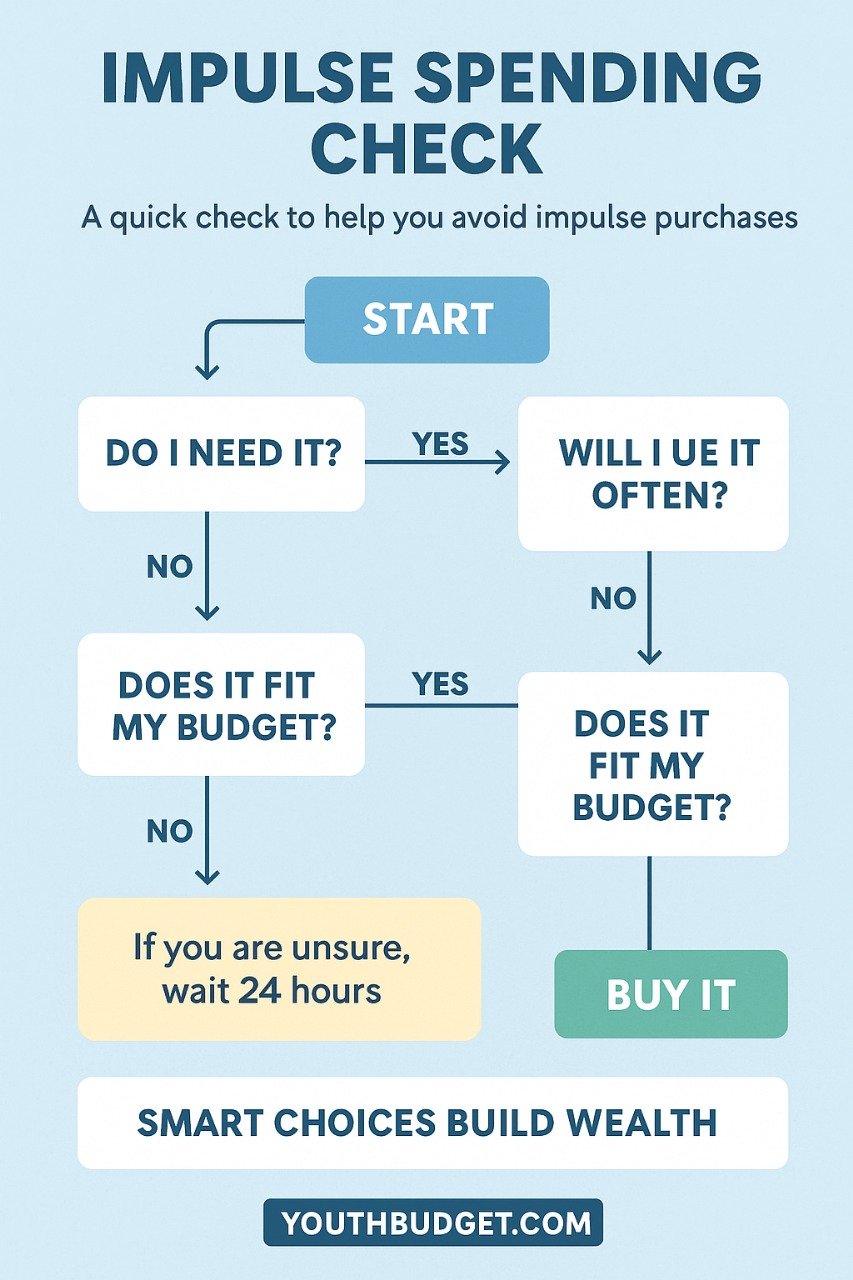

Impulse Spending Decision Chart

A flowchart to help you make smarter spending decisions and avoid unnecessary purchases.

7 Saving Tips for Financial Freedom

Practical money-saving strategies to help students achieve financial independence and build wealth.

Beginner Friendly Money Roadmap

A step-by-step guide to building financial literacy from the ground up with clear milestones.

Teen Debt Trap Warning Chart

Identify and avoid common financial pitfalls that lead to debt accumulation and financial stress.

Smart Spending Pyramid for Teens

Learn how to prioritize your spending with this visual hierarchy of financial needs and wants.

Interactive Financial Calculators

Powerful tools to help you plan, calculate, and make informed financial decisions with precision

Student Loan Payment Calculator

Calculate your monthly student loan payments and see how different repayment plans affect your budget over time.

Use CalculatorStudent Grocery Spending Calculator

Plan your weekly food budget and learn how to save on groceries without sacrificing nutrition.

Use CalculatorStudent Debt Assessment Calculator

Determine how much student debt is manageable based on your expected income after graduation.

Use CalculatorCollege Tuition Comparison Tool

Compare tuition costs across different colleges and calculate the long-term financial impact of your choice.

Use CalculatorRent Affordability Calculator

Determine how much rent you can afford based on your income, expenses, and financial goals.

Use CalculatorRobo-Advisor Comparison Tool

Compare different robo-advisor platforms to find the best investment option for your student budget.

Use CalculatorJob Application Tracker

Organize and track your job applications, interviews, and follow-ups in one convenient tool.

Use ToolNo-Spending Challenge

Take the no-spending challenge with this printable PDF to boost your savings and reset your spending habits.

Download PDFFrequently Asked Questions

Get answers to common questions about our infographics and interactive calculators

Our infographics and interactive calculators are specifically designed to address the unique financial challenges students face. The visual guides simplify complex concepts like budgeting, saving, and debt management, while the calculators provide personalized insights into your specific financial situation, helping you make informed decisions about loans, expenses, and future planning.

Yes, all our infographics and interactive calculators are completely free. We believe financial education should be accessible to all students, regardless of their economic background. There are no hidden fees, subscriptions, or premium paywalls - just valuable financial education resources.

We regularly update our resources to reflect current financial trends, interest rates, and educational best practices. Our team of financial educators reviews all content quarterly to ensure accuracy and relevance. Major updates are announced through our newsletter and social media channels.