Table of Contents

More valuable than any material gift is helping young adults take their first step toward financial independence. Choosing the best investment gifts for young adults in 2025 not only gives them a present that grows in value but also imparts lifelong money skills.

In this guide to the top investment gift ideas, we’ll compare the best options—from brokerage accounts to budgeting apps—so you can pick the one that fits their future.

The best investment gifts for young adults, their significance, and how to present them in a way that is both meaningful and understandable will all be covered in this guide.

The Power of Investment Gifts for Young Adults

Young people in the United States are approaching an era in which financial independence is more important than ever. Student debt, inflation, and rising living costs mean that kids need to acquire good financial habits from a young age. Giving an investment gift to a young one is a great way to boost their financial success and help them develop long-term money management skills.

Investment gifts are not your typical gifts for young adults. They emphasize the need for long-term planning, discipline, and patience. Most importantly, they provide young people a big edge when it comes to building money over the long run.

1. Custodial Brokerage Accounts (UGMA/UTMA)

A custodial account is a perfect way to introduce children to the world of saving and investing. By setting up an account under an adult’s control, minors can start their investment journey early.

These accounts can hold a variety of assets like real estate, art, securities, and even insurance policies under laws like the Uniform Transfers to Minors Act (UTMA) and Uniform Gift to Minors Act (UGMA). It’s an excellent gift that teaches financial responsibility and offers young individuals a head start on their financial success.

In addition to these benefits, custodial accounts allow for the funding of various financial assets without contribution limits or withdrawal penalties. Once the minor reaches the age of termination, they take full control over the account. This irrevocable gift also helps young people start learning about tax, income, and investment early, which makes it an excellent tool for financial education and planning for retirement.

Contribute to an IRA

For a teen or 20-something who’s starting to earn an income, opening an IRA is a great investment gift. A custodial IRA allows for annual contributions of up to $7,000 in 2024, teaching the young adult about the power of delayed gratification and compounded growth.

The gift of an IRA offers tax-sheltered returns, making it an excellent way to teach them about retirement planning and long-term financial security.

By contributing to a Roth IRA, you can help them amass significant savings by the time they retire, with the potential to reach as much as $1.7 million by age 67.

This investment also introduces them to the tax benefits of retirement accounts, ensuring they understand how contributions grow over time, setting them up for a financially secure future. It’s a meaningful way to help young people start planning for financial freedom.

Ready to see how your investments can grow?

Click the button below to use the Investment Growth Calculator and start planning your future today!

Buy them a stock (or two)

Gifting a stock or two is an exciting way to introduce young adults to the world of investing. By opening a custodial account, you can buy shares in companies they’re familiar with, such as a movie studio or video game manufacturer.

This not only makes investing fun, but it also serves as a valuable educational experience about market dynamics and stock performance. A financial professional can guide you on selecting the best assets for these young investors.

For those worried about the cost of individual stocks, fractional share investing is a great option. By using online brokerages, young adults can start investing with as little as $5 or $10.

Over time, these small investments can grow, teaching them the importance of long-term planning and the benefits of dividends. This gift also promotes good financial habits and sets them up for future financial growth.

Shares of an Index Fund

Investing in an index fund is a smart, long-term strategy for a young adult’s financial future. By contributing a lump sum, such as $2,500, and adding to it annually, you can help them build wealth over time with consistent returns.

If the fund earns a 10% return, they could accumulate $26,329 by age 25. This is a great way to teach them about dollar cost averaging and investment growth.

Index funds also help introduce the concept of financial literacy by offering a more diversified and less risky approach compared to individual stocks. Encouraging them to invest monthly fosters a habit of saving regularly, which is essential for achieving financial freedom.

This gift not only provides a solid investment strategy but also sets them on the path to personal finance growth and eventual retirement.

Pay for a financial plan

A financial plan is an invaluable gift for young adults facing student loans, credit card debt, or the pressures of managing limited income. By paying for a session with a financial professional, you can help them create a clear road map to reach their financial goals.

This planning will help them navigate short-term and long-term goals while building financial discipline for the future.

The gift of a financial plan also encourages them to think about emergency funds and future financial security. A financial professional can suggest strategies to help them manage debt while saving for bigger goals, such as homeownership or retirement.

By teaching young people how to manage their finances early, you give them the tools they need for a lifetime of financial success.

A charitable donation

Instead of a traditional gift, consider giving the young adults in your life a charitable donation gift. This can be in the form of a gift certificate to donate to a charity of their choice.

It’s a meaningful way to teach empathy and the importance of giving back. The gift of charity exposes them to valuable causes like poverty, animal welfare, or healthcare research, fostering a strong sense of social responsibility.

Charitable giving also encourages family discussions about values and teaches the importance of contributing to the community. By involving them in the decision-making process of where the donation goes, it becomes a family tradition that not only supports a good cause but also instills financial education.

This gift is a powerful life lesson in mutuality, showing the importance of supporting causes that matter to them.

Give a cash gift

A cash gift is a versatile and highly flexible option for young adults. This gift allows them to use the money in whatever way they see fit, whether it’s for tuition, a student loan, or a personal financial goal. It’s a great option for those who need to manage their financial situation and would appreciate the flexibility it offers.

Cash gifts can also be used as a way to help them understand the importance of budgeting and saving. With an annual gift tax exclusion of $18,000 for 2024, it’s a generous gift that won’t trigger tax liabilities.

Whether they use it for short-term needs or invest it for long-term growth, a cash gift is always a welcome and practical way to help them manage their financial responsibilities.

Pay for tuition

Paying for tuition is one of the most impactful gifts you can give to a young adult. Whether they are attending private school, college, or graduate school, this financial assistance will help relieve the burden of student debt.

Directly paying the tuition to the educational institution allows you to give a gift without worrying about tax exemptions or the annual gift tax exclusion.

This gift helps provide the recipient with an opportunity to focus on their studies without the added stress of financial burdens. By paying for tuition, you are not only supporting their education but also investing in their future. It’s a thoughtful way to help them on their path to higher education and career success.

Pay off student debt

Student debt is a major concern for many young adults. By paying off their student loan, you’re helping them alleviate the financial burden that comes with it. With the ability to gift up to $18,000 in 2024 without incurring a gift tax, this gift can make a significant impact on their financial freedom and ability to move forward in life.

By helping them pay off student debt, you provide them with a foundation to build on, whether it’s for saving or investing in their future. This gift not only offers debt relief but also encourages better financial habits and prepares them for long-term financial stability.

Financial Literacy Books:

The Simple Guide to Wealth by J.L. Collins

This book provides a straightforward approach to wealth-building and financial independence. It simplifies complex concepts and teaches readers how to build wealth by saving and investing over time. It’s perfect for young adults who want to learn about personal finance and long-term investment strategies.The Psychology of Money by Morgan Housel

This book explores how our emotions and habits impact our financial decisions. It emphasizes that wealth is not just about earning more but managing what you have. With insightful lessons on money management, this book helps young adults develop better financial habits and a healthy relationship with money.A Random Walk Down Wall Street by Burton Malkiel

A classic for anyone wanting to understand investment strategies, markets, and financial freedom. This book argues that investing in low-cost index funds is the most reliable way to build wealth over the long term. It’s ideal for young adults looking to start their investment journey.Retire Before Mom & Dad by Rob Berger

This book provides practical strategies for financial independence and early retirement. It focuses on how young adults can achieve their financial goals by living below their means, investing smartly, and planning ahead. Perfect for those aiming to retire early and live a life free from financial stress.The Bogleheads’ Guide to Investing by Taylor Larimore

A guide that emphasizes the principles of low-cost, long-term investing. The book provides a step-by-step approach to investing, focusing on simple strategies that work for most people. It’s a great resource for young adults just beginning to explore investment strategies.

These books provide valuable insights into financial literacy, personal finance, and wealth management, setting young adults up for success in managing their money and building a secure financial future.

They teach everything from basic economics to complex investment strategies, making them excellent tools for education and financial growth.

Frequently Asked Questions

Last Greetings

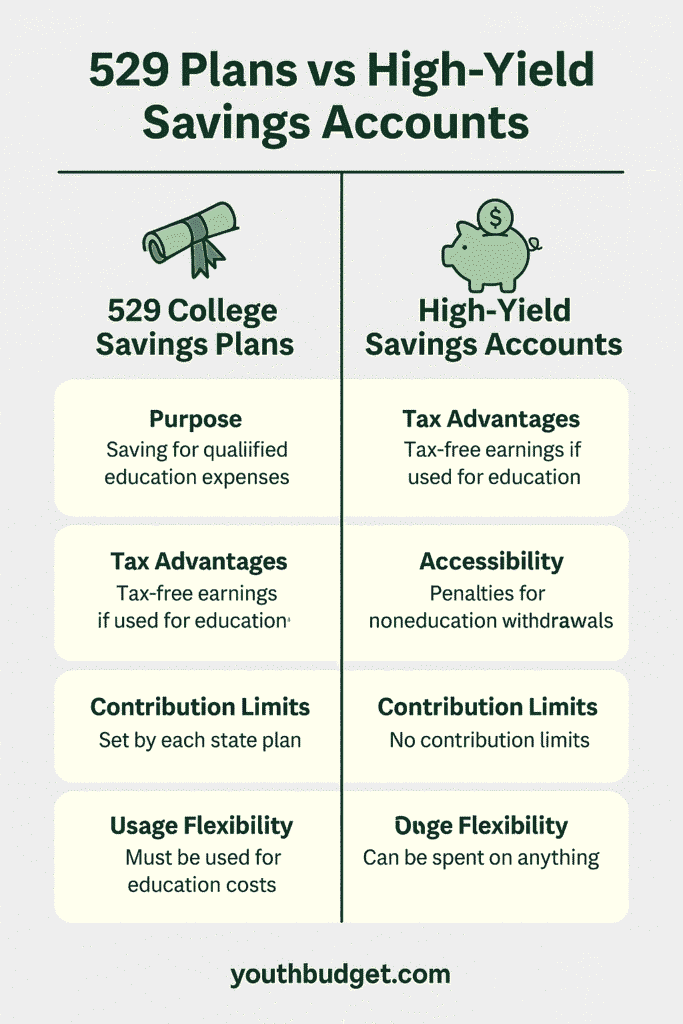

In summary, this 2025 guide to the best investment gifts for young adults shows that these aren’t just presents—they are pathways to lifelong wealth. Whether you choose a top brokerage account, a high-interest savings account, or the best financial literacy books, each option helps the next generation build financial freedom.

Fresh money guides you’ll love

Slash months off your auto loan with smart payment hacks.

Read nowYes, it’s possible: rent and still build your home fund.

Read nowStart early, save smart, and unlock your first place.

Read nowTurn the dream trip into a reality with fun saving tricks.

Read now

5 thoughts on “Investment Gifts for Young Adults: A Thoughtful Way to Build Their Future”