If you’re planning to apply for a student loan to cover school expenses, you’re likely wondering how long does it take to get a student loan. The timeline can vary widely—from a few days to several weeks—depending on the timing of your application, your semester start date, possible lender delays, and the loan type you’re pursuing.

This guide gives a comprehensive overview of the student loan timeline and the main loan options available to students. You’ll get the information you need to navigate the application process with confidence so the experience feels as smooth and stress-free as possible.

Bottom Line Up Front

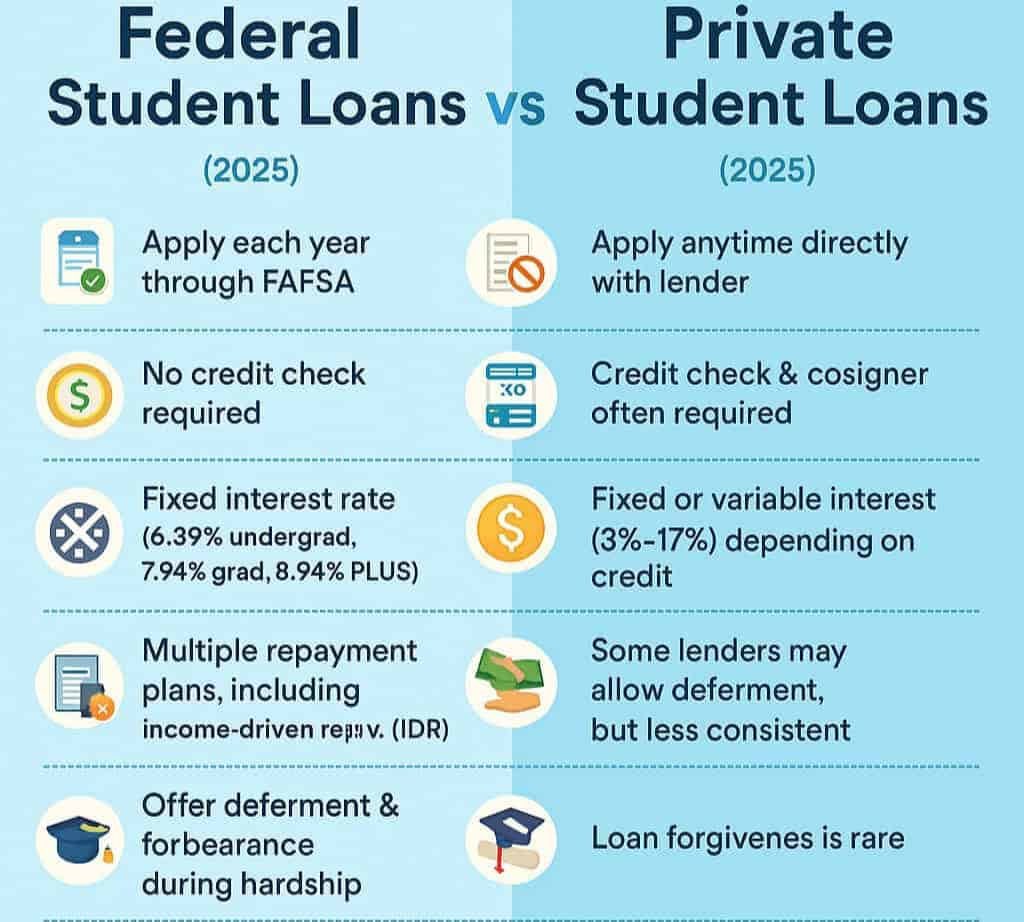

- Federal student loan timelines typically run from a few weeks to a few months because the application and approval process involves more steps.

- Private student loan timelines are often faster (days to weeks) since lenders usually require fewer steps.

- Apply for federal loans first for flexible repayment options and opportunities for forgiveness.

- Federal loans have borrowing limits; if they don’t cover the full cost of attendance, you can use private student loans to make up the difference.

Timeline by Loan Type

Federal Timelines

The federal student loan process involves several formal steps, which means it usually takes a few weeks to a few months from application to disbursement. First, you must complete the FAFSA and submit it either online or by mail. Once processed, you’ll receive your Student Aid Report (SAR) and eventually financial aid award letters from the schools that accepted you.

After choosing your aid, you’ll complete loan counseling and sign your Master Promissory Note (MPN) before funds are released. These steps, along with school processing schedules, often make federal timelines longer than private ones.

Private Timelines

Private student loans typically have faster processing times—often just a few days to several weeks. Lenders conduct a credit check, review documentation, and approve loans much more quickly than the federal process. Once approved, your school certifies the loan amount, and funds are disbursed shortly after.

For students asking how fast can I get a student loan, how quickly can you get a student loan, or how fast can you get a student loan, private loans are usually the fastest route—especially if your documents and credit profile are ready.

Step-by-Step: From Application to Disbursement

Check Status and Speed Bottlenecks

Once you’ve submitted your student loan application, it’s important to keep track of its status to avoid unnecessary delays. For federal student loans, you can check the status of your FAFSA online at fafsa.gov or by phone. Log in, select whether you’re a student, parent, or preparer, and navigate to the “My FAFSA” page. If you applied by mail, processing typically takes around 7–10 days, so allow that time before checking your status.

For private student loans, contact your lender directly. Many private lenders, such as Earnest, have support teams or online portals where you can monitor progress and provide any additional information required. Staying proactive during this stage helps shorten the overall timeline and positions you to accept your student loans as soon as they’re approved.

Factors That May Affect the Timeline

Completeness of Your Application

One of the most common causes of delays in the student loan timeline is incomplete applications. Missing forms, identification documents, or financial details can significantly slow down both federal and private lenders. To avoid setbacks, ensure all required paperwork — including ID, income information, and supporting documents — is accurate and submitted correctly the first time.

Verification Requirements

For federal student loans, additional FAFSA verification may be required by your financial aid office. This means they’ll ask for extra documentation to confirm the details you provided. This step can add days or even weeks to the processing timeline, depending on how quickly you respond and how busy the office is during the review period.

Lender Policies & Peak Periods

Each lender has unique policies and processing times, which directly affect how long it takes to get approved and receive funds. During peak application periods, like the weeks leading up to a new academic year, timelines can stretch further. Understanding these variables early on helps you plan ahead and minimize unexpected delays in your student loan disbursement.

Fast-Track Options (When You Need Money Sooner)

Private Lenders with Faster Turnarounds

If you’re asking how fast can I get a student loan or how quickly can you get a student loan, private lenders often provide the quickest route. Many private lenders offer streamlined applications, instant credit checks, and fast approval decisions—sometimes within just a few days. Unlike federal loans, private lenders typically don’t have lengthy verification steps, and once the school certifies the loan amount, disbursement can happen soon after. Choosing a lender known for efficient processing can significantly reduce the waiting period.

Preparing Documents to Avoid Delays

One of the smartest ways to speed things up is by preparing all necessary documentation before applying. This includes your identification (driver’s license or Social Security number), proof of income, school certification information, and if needed, co-signer details. Submitting a complete application early, responding promptly to lender requests, and ensuring no data errors can eliminate common bottlenecks in both federal and private loan timelines. Planning ahead not only accelerates approval but also ensures funds are ready when your semester begins.

Cosigner Pathways (Affecting Speed & Approval Odds)

Getting a Cosigner

For many students, having a cosigner can speed up loan approval and help secure better terms. A cosigner with a strong credit score and financial history can increase your chances of getting approved quickly, especially for private student loans. This is particularly useful for students with limited credit or income. If you’re wondering how to get a cosigner for a student loan or how to find a cosigner for a student loan, start by approaching trusted family members or close contacts early in the application process to avoid delays.

Removing a Cosigner

Over time, you might want to remove a cosigner from a student loan, either to take full responsibility or to release their financial obligation. Many private lenders allow cosigner release after a set number of on-time payments and proof of creditworthiness. If you’re exploring how to remove a cosigner from a student loan, how to remove cosigner from student loan, or how to get a cosigner off a student loan, keep in mind that this process may involve a credit review and sometimes a refinancing step. Understanding these timelines early on helps manage expectations and avoid unexpected delays later.

Consolidation & Processing Times

Federal vs. Private Consolidation Windows

If you’re considering student loan consolidation, the timeline depends on whether you select a federal consolidation program or a private refinancing option. For federal loans, consolidation typically takes 30 to 90 days. This includes the application review, payoff of existing loans, and issuing a new consolidated loan.

For private lenders, consolidation or refinancing is usually much faster — often just a few weeks — provided your documents, credit history, and income information are in order. Understanding these federal vs. private consolidation windows helps you plan for additional processing time compared to your initial loan disbursement.

Why Consolidation Timelines Differ

Federal programs follow standardized government procedures and multiple verification stages, which naturally lengthen processing. In contrast, private lenders can streamline the review process, especially if you’re a strong applicant with all paperwork ready. Knowing these distinctions ensures you pick the right path for your timeline and financial strategy.

Paying & Acceptance Mechanics (Timeline Impact)

Accepting and Activating Your Aid

Once your loan is approved, you’ll need to accept your student loans to officially activate them. For federal student loans, this involves logging in to your FAFSA or school portal, reviewing the award letter, and completing any required loan counseling or Master Promissory Note (MPN) signatures.

Delays often happen when students forget to accept their aid promptly or miss important notifications from their financial aid office. Doing this step early ensures your funds are queued for disbursement on time.

Using a Credit Card for Payments

Some borrowers explore using credit cards for loan payments—either to bridge timing gaps or earn rewards. If you’re looking at how to pay student loans with a credit card or how to pay off student loans with credit card, keep in mind that while some private lenders or third-party services allow this, there may be fees, interest implications, and processing delays. This option should be carefully evaluated, as it usually doesn’t speed up loan processing and can add costs if not managed strategically.

Borrowing Amounts & Disbursement Scheduling

Federal Borrowing Limits and Disbursement

Understanding how much you can borrow and when the funds are released is a key part of answering how long does it take to get a student loan. For federal student loans, your borrowing amount depends on your financial need, student status, and annual or lifetime borrowing limits.

Once your FAFSA is submitted and processed, you’ll receive an award letter that outlines how much you’re eligible to borrow. The school then confirms your cost of attendance—including tuition, fees, room and board, and other educational expenses—before finalizing disbursement schedules.

Private Borrowing Amounts and Timing

For private student loans, borrowing amounts are determined by the lender and your creditworthiness. Many private lenders allow you to borrow up to 100% of the school’s certified cost of attendance, often covering any remaining expenses that federal loans don’t. Because private loans usually involve fewer steps, the time between application approval and disbursement is often shorter—sometimes just a few days after school certification.

Refunds and Budget Planning

In both cases, the disbursement of funds typically happens at the start of your academic term, and any excess funds after tuition and fees may be refunded to you for housing, books, or other educational costs. Being aware of these amounts and timelines helps you plan your budget effectively and avoid unexpected financial gaps.

Managing Funds While You Wait (Bridging the Gap)

Understand the Disbursement Timeline

Waiting for student loan funds to arrive can be stressful, especially when essential expenses like housing, books, or meal plans are due before disbursement. Most schools don’t release federal loan funds until the start of the academic term, and for first-year undergraduates or first-time borrowers, this can be delayed up to 30 days after enrollment. If you’re depending on this money for rent or other upfront costs, it’s crucial to plan ahead.

Prioritize Your Expenses

Start by prioritizing expenses—housing, meals, and required materials should come first. If your excess funds aren’t needed for these essentials, consider returning them to the lender or applying them as a payment to reduce future interest. To receive funds quickly once they are released, set up a bank account that supports direct deposit, as many schools offer this option for faster refunds.

Build a Financial Cushion

Additionally, building even a small emergency fund, such as $20/month, can give you a safety net during unexpected delays. Keeping communication open with your financial aid office ensures you know the exact disbursement timeline. By managing your funds responsibly while you wait, you can bridge short-term gaps without turning to costly credit options.

Borrowing Amounts & Disbursement Scheduling

Federal Borrowing Limits and Disbursement

Understanding how much you can borrow and when the funds are released is a key part of answering how long does it take to get a student loan. For federal student loans, your borrowing amount depends on your financial need, student status, and annual or lifetime borrowing limits.

Once your FAFSA is submitted and processed, you’ll receive an award letter that outlines how much you’re eligible to borrow. The school then confirms your cost of attendance—including tuition, fees, room and board, and other educational expenses—before finalizing disbursement schedules.

Private Borrowing Amounts and Timing

For private student loans, borrowing amounts are determined by the lender and your creditworthiness. Many private lenders allow you to borrow up to 100% of the school’s certified cost of attendance, often covering any remaining expenses that federal loans don’t.

Because private loans usually involve fewer steps, the time between application approval and disbursement is often shorter—sometimes just a few days after school certification.

Refunds and Budget Planning

In both cases, the disbursement of funds typically happens at the start of your academic term, and any excess funds after tuition and fees may be refunded to you for housing, books, or other educational costs. Being aware of these amounts and timelines helps you plan your budget effectively and avoid unexpected financial gaps.

Key Takeaways

- Timelines vary depending on the type of loan — federal student loans usually take a few weeks to a few months, while private student loans can be processed in just a few days to several weeks, depending on lender efficiency and documentation.

- Completing your application accurately, submitting all required documents, and staying on top of status checks helps speed up both federal and private loan approvals.

- Private lenders often offer faster turnaround times than federal loans, especially when you have a cosigner and your credit information is ready.

- Federal loans come with forgiveness opportunities, flexible repayment options, and borrowing limits, so it’s best to apply for them first before turning to private loans.

- If you’re consolidating or refinancing, federal consolidation may take 30–90 days, while private consolidation is often quicker.

- Planning ahead for disbursement dates, setting up direct deposit, and creating a small emergency fund can help bridge the gap while waiting for loan funds to arrive.

- Strategic preparation—like gathering documents early, understanding timelines, and choosing efficient lenders—ensures your student loan process is as smooth and stress-free as possible

Related Guides to Strengthen Your Financial Strategy

If you’re planning your next financial moves, these related guides can help you stay one step ahead. Learn smart ways to pay for college without relying on parents, discover practical methods to pay off your car loan faster, and understand how to avoid debt collection with confidence.

For those managing education expenses, don’t miss our in-depth guide on how to get out of private student loans — a comprehensive resource on settlement strategies, refinancing, and legal relief options.

Each article offers clear, actionable advice to strengthen your financial planning and give you more control over your money.

Frequently Asked Questions

How long does it take to get a student loan?

The timeline for getting a student loan depends on the type of loan and the lender. Federal student loans usually take a few weeks to a few months, since the process includes FAFSA submission, school verification, and disbursement schedules. Private student loans are often faster — typically a few days to several weeks — depending on how quickly your application and documents are processed.

How fast can I get a student loan?

You can get a private student loan within a few days if your documents, credit check, and school certification are ready. Federal loans take longer because they require extra steps like FAFSA processing, loan counseling, and signing a Master Promissory Note before disbursement.

How long does it take to consolidate student loans?

Federal consolidation typically takes 30–90 days, as it involves application review and issuing a new loan. Private refinancing or consolidation is usually faster and can be completed within a few weeks, depending on the lender and documentation.

How can I get a student loan without a cosigner?

You can apply for federal student loans without a cosigner by completing the FAFSA and meeting eligibility requirements. For private loans, a strong credit score, stable income, and solid financial history can increase your chances of getting approved without needing a cosigner.

How to remove a cosigner from a student loan?

Many private lenders offer cosigner release programs after a certain number of on-time payments and a credit review. Alternatively, you can refinance the loan in your name only, provided you meet the credit and income requirements.

How to accept student loans?

To accept federal student loans, log in to your FAFSA or school portal, review your award letter, and complete required steps like loan counseling and signing the Master Promissory Note (MPN). For private loans, acceptance usually happens through your lender’s online portal.

Can I pay student loans with a credit card?

Some private lenders or third-party services allow credit card payments, but this can include processing fees and interest charges. Federal loan servicers typically don’t accept direct credit card payments, so this option should be used strategically if available.

External Citations & Resource

Disclaimer

The information provided in this article is for educational and informational purposes only. It does not constitute financial, legal, or tax advice. Student loan policies, lender requirements, and processing timelines may vary depending on individual circumstances and changing regulations. Borrowers are encouraged to consult their financial aid office, licensed financial professionals, or legal advisors before making any loan-related decisions. YouthBudget.com is not responsible for any actions taken based on the information provided.