Table of Contents

Learning budgeting as a student can feel overwhelming at first, but it doesn’t have to be. Whether you’re in high school or college, building strong money habits early will make life easier. With the right student budgeting tips, you’ll be able to manage your expenses, save for goals, and still enjoy the things you love.

Even if you think money management for students sounds complicated, it starts with simple habits—like tracking expenses and setting small goals. These steps are the foundation of college student budgeting and will help you feel in control of your money.

Back when I was in high school, I thought saving $20 a week wasn’t worth it. But by the end of the year, that small habit helped me buy my first laptop.

Many students believe that budgeting as a student is unnecessary since parents or part-time jobs cover most expenses. However, even small daily costs like snacks and coffee add up quickly and can catch you off guard if you don’t practice smart budgeting as a student habit.

What is a budget?

A budget is a simple plan that helps you spend your money wisely. As a student, you might rely on your student loan, and sometimes you may struggle to make ends meet.

Creating a budget can help you get back on track by deciding in advance how much to spend on important things like rent, food, and socialising. By planning these costs in advance, you can stay on top of your finances and prepare for unexpected costs or a drop in income.

Effective budgeting ensures you don’t overstretch yourself and helps you prioritise your spending. You don’t need complicated maths or special equipment; just follow the steps to build your budget carefully.

How to Start Budgeting as a Student (Beginner Guide)

Step 1: Choose where to make your budget

The first step in budgeting is to decide where to create your budget. You can use a piece of paper or a notebook for a quick start and keep a calculator nearby. A spreadsheet such as Excel is ideal if you want to save and update your budget, and it can even handle the sums automatically.

If you prefer digital tools, try interactive budgets available online or through an app like the Money Advice Service budget planner, which makes the process more structured and efficient.

Step 2: List your monthly income

Next, list all the money coming in each month. This includes your student loan, wages from a job or self employment, bursaries, grants, welfare benefits, disability allowance, parental contribution, hardship funds, and emergency support.

If you receive one-off or bulk payments, divide them by the number of months to get a clear monthly figure. Once all income sources are identified, add up the amounts to calculate your total monthly income. This clear overview is crucial for sound student budgeting.

Step 3: Track your monthly spending

To manage money effectively, think about what you spend or set aside for different areas. Start with essential costs, like payments you must make regularly or cannot easily skip, such as rent, bills, transport to work, and course materials.

Then consider flexible costs, which depend on your finances, like socialising, hobbies, and snacks. Review your bank statements, receipts, banking apps, and digital wallets, or use a breakdown of student spending to guide your estimates. Finally, add up your spending to find your total monthly spending

You’ve started a smart money move. Next, choose where to go: tighten weekly spending, grow savings with compounding, sanity-check your rent, or wipe out debt faster. Each tool opens instantly and keeps your progress simple.

Lock a weekly cap for “fun” money so you don’t drift after payday.

Turn small monthly deposits into a timeline you can actually see.

Snowball vs. avalanche—get the date and total interest, pick and go.

Reality-check your rent vs. income before you sign anything.

Map income to needs/wants and lock a plan you’ll stick with.

Prefer a 1-glance map? Drag-and-drop style planning.

Pick a number + date. We’ll show monthly deposits to get there.

Add an extra payment and watch months drop off your timeline.

Estimate capital gains tax for rough planning (rules vary by country).

Tip: Finish one calculation? Pick your next step above and keep momentum going.

Step 4: Balance your budget

The goal is to spend less than your income each month. You can check this by subtracting your total monthly spending from your total monthly income. If you have money left over, consider putting it in a savings account to build back-up funds. If you’re struggling, don’t panic—review the steps carefully to regain balance and control.

Step 5: Try the 50/30/20 Rule (Simplified for Teens)

There’s a simple budget rule that a lot of adults tend to follow.

Classic rule:

- 50% for necessities (like lunch and school, or even lunch bills)

- 30% for shopping (hanging out, shopping, and even fast food)

- 20% for savings (Emergency fund, future goals like a laptop or trip)

But let’s be honest—budgeting as a student looks a bit different. You may not have had to pay for rent or buy groceries every week, so feel free to adjust the rule to better suit your lifestyle.

Money management as a student is much easier than for any adult. So, students can use a better version.

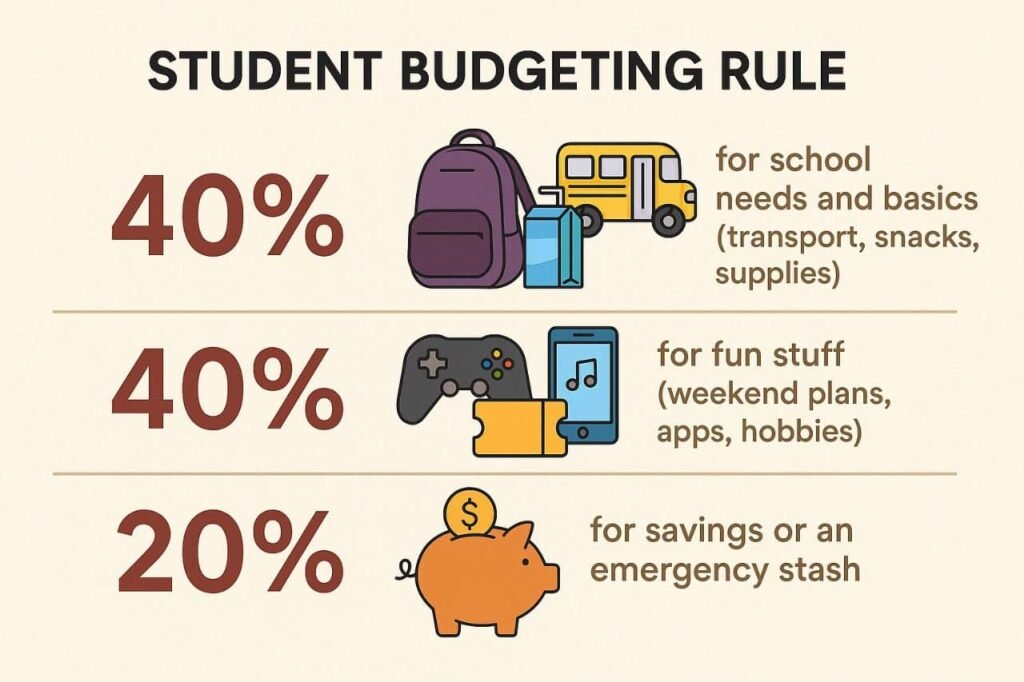

For Students:

- 40% for school needs and the basics (transport, snacks, school supplies)

- 40% for fun (weekend plans, apps, and even hobbies)

- 20% for savings or a stash for emergencies (because phone screens do crack)

The primary focus isn’t to hit the numbers exactly; instead, it’s to have control over your structure without losing your freedom. The different numbers you set for yourself may need to change once something shifts.

Step 6: Find out what you can get for free

As a student, it’s important to know about the things you don’t have to pay for, because this can make a real difference to your overall budget. For example, student houses are exempt from paying Council Tax when the property is occupied only by full-time university or college students.

Beyond housing benefits, there are also medical prescriptions you can get for free, which can save you a lot over time. These prescriptions are free for all residents of Scotland, Northern Ireland, and Wales, but in England most people still have to pay.

For students aged 16-18, the good news is that they don’t have to pay for prescriptions. Once you turn 19, you might be eligible to apply for the NHS Low Income Scheme. If your application is accepted, you can continue receiving free prescriptions.

This support also applies to dental treatment and sight tests, which helps you manage health costs without adding financial pressure. Making use of these opportunities is a smart budgeting strategy for students.

Putting your budget to work

Once your budget is set, pick a regular date to go through it. Whether at the start or end of the month, regular check-ins help when finances fluctuate. Pay essential costs first by putting money aside in a safe place or a separate account until bills are due.

If you have income left over after covering essential costs, divide it for flexible costs. Avoid simply spending as you go; set limits for each cost and aim to not pay more each month. This strategy builds discipline and control over time.

Tackling problems

When the cost of living increases, you may feel extra pressure as essential costs become greater than your income or funding. Start by reviewing your essentials list. We often enjoy or appreciate things that are not truly essential but desirable. For example, takeaways and ready meals are quick and easy, but they cost more than making your own meals from scratch.

If you’re not confident in the kitchen, YouTube offers no-fuss recipes to cook on a budget. A car might seem essential, but maintenance and MOT are expensive—public transport, walking, or car share schemes can be cheaper. Look for ways to spend less, like switching to cheaper brands.

If after you’ve checked, essential costs still exceed money coming in, book an appointment with your university. They may offer support funds, financial hardship help, and expert advice to tackle money worries, including debt fears. Also, explore practical ways to manage accommodation and other tricky costs to avoid money problems.

Common Mistakes to Avoid in Budgeting as a Student

Starting off strong, almost anyone can fall off track due to some common budgeting habits. Don’t fret; this occurs to almost everyone at some point. The takeaway here is adjusting from your mistakes early on.

- Not keeping track of your spending—Without keeping track of your expenses, you are not able to implement changes for better budgeting.

- Overly ambitious goals—Attempting to save $500 while a $100 income is coming in is certainly putting yourself under a lot of stress and is far from a realistic approach.

- Bumping into surprise costs – Unaccounted for expenses such as school dances, giving birthday presents, or class trips can all contribute to breaking your budget.

- Overly strict restraints – Your budget needs to evolve as you do. Rigidity is not at all a smart approach.

- Avoiding all fun: A healthy budget leaves room for enjoyment. Money management for students works best when it’s flexible enough to include fun spending without guilt.

Ready to take control of your finances? Explore these practical budgeting guides tailored for students:

Keep going

Your budget doesn’t have to be perfect on the first go. It gets easier with practice. Once you get the hang of it, set a money goal to build financial security or aim for a balanced budget each month. If you have enough income, you might save for an emergency fund or a treat to reward your hard work.

Set aside a fixed amount, cut back on unnecessary spending, and direct the savings toward your goal. Clear money goals give a sense of direction, encourage you to keep going, and make budgets meaningful.

Budgeting is not just for people who do not have enough money. It is for everyone who wants to make the most of their money.”

— Rosette Mugidde Wamambe

Must-Read Blogs to Boost Your Money Skills

Ready to build smart money habits? Dive into these resources to learn how to earn, save, and spend wisely.

Fresh money guides you’ll love

Slash months off your auto loan with smart payment hacks.

Read nowYes, it’s possible: rent and still build your home fund.

Read nowStart early, save smart, and unlock your first place.

Read nowTurn the dream trip into a reality with fun saving tricks.

Read now

2 thoughts on “Budgeting as a Student: Simple Money Tips for High School & College Success”